At Top Dividend Stocks, our mission is to empower individual investors to build resilient, income-generating portfolios. We cut through the noise, providing meticulously researched analysis, practical strategies, and unbiased perspectives to help you make informed decisions and achieve long-term financial independence. We believe that smart dividend investing is not just about picking stocks, but about cultivating a sustainable income stream for life.

Dividend Expert’s Corner

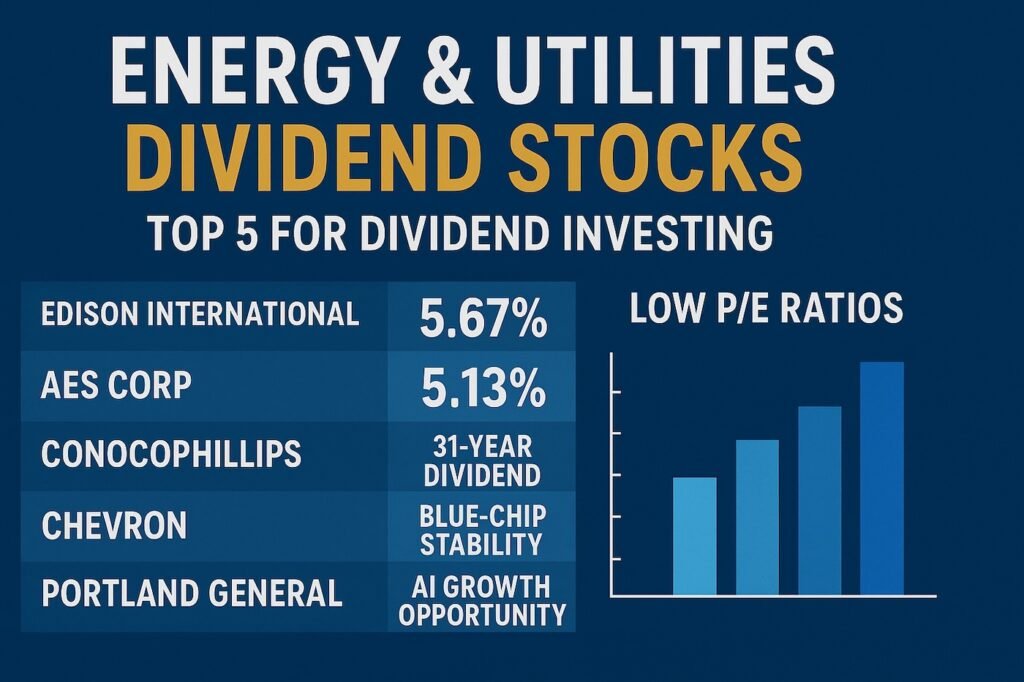

5 Best Energy & Utility Stocks for 2025: High Dividends, Low P/E Ratios (4%+ Yield)

Why Energy & Utility Stocks Deliver Superior Income in 2025 Energy prices surge. Interest rates…

Top 10 Dividend ETFs (Including Covered-Call Strategies) for Reliable Income

Main takeaway: For investors seeking steady passive income, a mix of traditional high-dividend ETFs and income-enhancing covered-call…

The Rise of Fractional Shares: Investing in Big Brands with Small Budgets

Main Takeaway: Fractional shares have revolutionized investing for U.S. investors, making it possible to own slices…

10 Best Swiss Dividend Stocks to Invest in Now

Main Takeaway: In today’s uncertain markets, building a reliable source of passive income is like assembling…

European Dividend Champions: Your Alpine-Grade Income Portfolio

Introduction I still remember the day I visited my grandfather’s chalet in the Swiss Alps….

5 Most Promising Dividend Stocks in the US Financial Sector: A Swiss Wealth Manager’s Selection

Picture the imposing granite facades of Wall Street’s financial titans, where behind mahogany boardroom tables,…