Picture yourself standing in the ornate trading hall of Credit Suisse’s headquarters in Zurich, where seasoned wealth managers have navigated market turbulence for over 160 years. As Asel, your Swiss wealth management expert, I’ve witnessed countless investors chase after the siren call of high-yield dividend stocks, only to discover that what glittered like gold was merely fool’s pyrite. Today, we’ll explore the sophisticated art of spotting safe high-yield stocks while avoiding the treacherous dividend yield traps that have ensnared even experienced investors.

The allure of high dividend yields becomes particularly magnetic during periods of low interest rates, when traditional fixed-income investments offer meager returns. However, the fundamental principle that governs successful dividend investing remains unchanged: sustainable income trumps spectacular yields every time. Understanding this distinction separates wealthy Swiss investors from those who chase unsustainable returns.

Understanding High-Yield Dividend Stocks: Beyond the Surface Appeal

High-yield dividend stocks are companies offering dividend yields significantly above the market average of approximately 1.3%. Generally, any stock yielding above 4% in today’s market environment qualifies as high-yield, though this threshold varies with prevailing interest rates and market conditions.

The attraction of high dividend yield stocks lies in their promise of substantial income generation. A $100,000 investment in a stock yielding 6% generates $6,000 annually in dividend income, compared to just $1,300 from an average market stock. This income differential becomes compelling for retirees, conservative investors, and those seeking passive income streams.

However, experienced dividend investors understand that yield alone tells an incomplete story. The dividend yield formula—annual dividends per share divided by current stock price—reveals a critical insight: yields can increase either through dividend growth or stock price decline. When a company’s stock price falls due to fundamental problems, the mathematical result creates an artificially attractive yield that masks underlying risks.

This phenomenon explains why some of the highest-yielding stocks in the market simultaneously represent the most dangerous investments. Companies like Dynex Capital, offering yields exceeding 16%, have cut their dividends seven times since 2013, delivering devastating losses to income-focused investors.

The Anatomy of Dividend Yield Traps: Recognizing Danger Signals

Dividend yield traps represent one of the most insidious risks facing income investors. These traps occur when high yields result from deteriorating business fundamentals rather than genuine income-generating capacity. Understanding the warning signs enables sophisticated investors to avoid these pitfalls entirely.

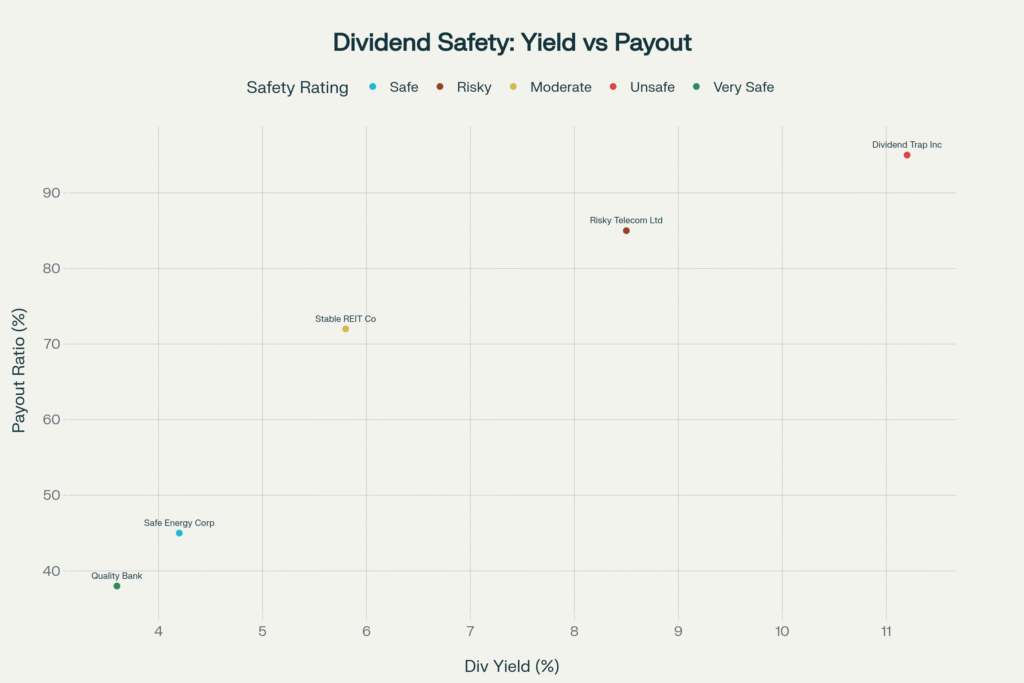

The most obvious red flag emerges when a company’s yield significantly exceeds its industry peers. If a utility company yields 12% while the sector average hovers around 4%, this divergence signals potential trouble rather than exceptional opportunity. Market efficiency suggests that such disparities rarely persist without underlying justification.

Payout ratios exceeding 80% represent another critical warning signal. The payout ratio—calculated as dividends paid divided by net income—measures the percentage of earnings distributed to shareholders. When companies pay out most or all of their profits as dividends, they retain insufficient capital for business reinvestment, debt reduction, or economic downturns.

Free cash flow coverage below 1.0 indicates that dividend payments exceed the company’s actual cash generation. This unsustainable situation forces companies to finance dividends through borrowing or asset sales, creating an inevitable path toward dividend cuts.

Essential Metrics for Evaluating Dividend Safety

Dividend coverage ratios serve as the foundation for assessing dividend sustainability. The dividend coverage ratio, calculated by dividing net income by total dividend payments, indicates how many times a company’s earnings can support its dividend obligations.

A coverage ratio above 2.0 suggests strong dividend security, meaning the company generates twice the earnings necessary to maintain current payments. Ratios between 1.5 and 2.0 indicate moderate safety but warrant closer scrutiny, while ratios below 1.5 signal significant risk of future dividend cuts.

Free cash flow coverage provides an even more conservative assessment by measuring dividend payments against actual cash generation rather than accounting profits. This metric, calculated as free cash flow divided by dividend payments, eliminates the impact of non-cash accounting adjustments that can distort earnings-based calculations.

The debt-to-equity ratio adds another crucial layer to dividend analysis. Companies carrying excessive debt face competing demands for their cash flow between debt service and dividend payments. During economic stress, lenders’ claims take priority over shareholder distributions, making highly leveraged companies more prone to dividend suspensions.

Net debt-to-EBITDA ratios exceeding 3.0 typically indicate elevated financial risk, particularly for dividend sustainability. Companies with strong balance sheets—characterized by conservative debt levels and robust cash positions—demonstrate superior capacity to maintain dividend payments through economic cycles.

Identifying Genuinely Safe High-Yield Opportunities

Despite the risks associated with high-yield investing, numerous companies offer attractive yields supported by strong fundamentals and sustainable business models. Dividend aristocrats and dividend kings—companies with 25+ and 50+ year track records of consecutive dividend increases—often provide yields in the 3-6% range while demonstrating exceptional dividend reliability.

Utility companies, real estate investment trusts (REITs), and master limited partnerships (MLPs) naturally generate higher yields due to their business structures and regulatory requirements. Many utilities are required to distribute substantial portions of their earnings to shareholders, creating inherently high-yield investments backed by regulated, stable cash flows.

Energy infrastructure companies like Clearway Energy offer yields approaching 6% supported by long-term contracts and predictable cash flows. These companies typically sign 15-20 year power purchase agreements with utilities, creating stable revenue streams that underpin reliable dividend payments.

Financial sector stocks, particularly regional banks and insurance companies, often provide attractive yields during certain market cycles. Companies like Citizens Financial Group and Royal Bank of Canada combine yields in the 3-4% range with strong dividend coverage ratios and conservative payout policies.

Advanced Analysis Techniques: The Swiss Approach

Swiss wealth management principles emphasize comprehensive analysis that extends beyond traditional metrics to assess long-term sustainability. This approach incorporates earnings quality analysis, examining whether company profits stem from sustainable operations or one-time events that artificially boost current performance.

Cash flow statement analysis reveals the true health of dividend-paying companies by distinguishing between earnings and actual cash generation. Companies generating strong operating cash flows consistently above their dividend requirements demonstrate superior dividend sustainability compared to those relying on accounting profits alone.

Industry lifecycle positioning influences dividend sustainability significantly. Mature industries with stable demand patterns—such as utilities, consumer staples, and telecommunications—typically support more reliable dividend payments than cyclical sectors subject to dramatic demand fluctuations.

Management track record evaluation provides insights into dividend policy consistency and financial discipline. Companies led by management teams with long histories of conservative financial management and shareholder-friendly policies typically maintain more reliable dividend streams than those with frequent leadership changes or aggressive growth strategies.

Sector-Specific Considerations for High-Yield Investing

Different sectors present unique opportunities and risks for high-yield dividend investing. Utility stocks traditionally offer the most stable high-yield opportunities, with companies like Black Hills Corporation providing yields around 4.7% backed by regulated rate structures and essential service monopolies.

Real Estate Investment Trusts (REITs) offer another attractive high-yield category, with companies like Healthpeak Properties generating yields above 5% through diversified real estate portfolios and long-term lease agreements. However, REITs face interest rate sensitivity and property market risks that require careful evaluation.

Energy sector investments present both the highest potential yields and greatest risks. Master Limited Partnerships (MLPs) and energy infrastructure companies often yield 6-10%, but commodity price volatility and regulatory changes create significant dividend sustainability risks.

Telecommunications companies occupy a middle ground, offering yields typically in the 4-7% range supported by recurring subscriber revenues but facing competitive pressures from technological disruption and capital-intensive network upgrade requirements.

Current Market Environment and High-Yield Opportunities

The 2025 market environment presents unique opportunities for high-yield dividend investing. Rising interest rates have increased the relative attractiveness of dividend yields compared to government securities, while market volatility has created valuation opportunities in previously expensive dividend-paying sectors.

Financial sector recovery has produced numerous high-quality dividend opportunities, with major banks and insurance companies offering yields in the 3-4% range while maintaining conservative payout ratios and strong balance sheets. Companies like Morgan Stanley and MetLife combine attractive yields with improving earnings prospects and disciplined capital management.

Energy sector stabilization has restored dividend sustainability to many previously risky high-yield investments. Companies that survived the 2020 energy crisis have emerged with strengthened balance sheets, reduced debt levels, and more conservative dividend policies while maintaining attractive yield levels.

Risk Management Strategies for High-Yield Portfolios

Successful high-yield dividend investing requires sophisticated risk management approaches that go beyond individual stock selection. Portfolio diversification across sectors, geographic regions, and company sizes reduces concentration risk while maintaining attractive overall yields.

Position sizing becomes critical when investing in higher-risk, higher-yield securities. Swiss wealth management principles suggest limiting individual high-yield positions to 2-3% of total portfolio value, preventing any single dividend cut from significantly impacting overall income generation.

Regular monitoring and rebalancing ensure that portfolio composition remains aligned with risk objectives as market conditions evolve. This includes systematically reviewing dividend coverage ratios, payout trends, and business fundamentals on at least a quarterly basis.

Exit strategies should be established before investing, with clear criteria for selling positions when dividend safety metrics deteriorate below acceptable thresholds. This disciplined approach prevents emotional decision-making during market stress periods when clear thinking becomes most valuable.

Building a Sustainable High-Yield Portfolio

Constructing a sustainable high-yield dividend portfolio requires balancing income generation with capital preservation and growth potential. The optimal approach combines dividend aristocrats offering moderate yields with carefully selected higher-yielding opportunities that meet strict safety criteria.

Core holdings should consist of established companies with 10+ year dividend growth histories, yields in the 3-5% range, and conservative payout ratios below 60%. These positions provide portfolio stability and reliable income growth over time.

Satellite positions can include higher-yielding opportunities in the 5-8% range, provided they meet comprehensive safety criteria including strong cash flow coverage, conservative debt levels, and defensible competitive positions. These positions should represent no more than 30-40% of total high-yield allocation.

Geographic diversification adds another layer of risk management, with international dividend-paying companies offering exposure to different economic cycles, currency movements, and regulatory environments. Swiss, Canadian, and Australian markets provide particularly attractive dividend-paying opportunities with different risk characteristics than U.S. markets.

Conclusion: Mastering the Art of Safe High-Yield Investing

Spotting safe high-yield stocks represents both an art and a science, requiring the analytical rigor of Swiss banking combined with the patience of long-term wealth building. The key lies not in finding the highest yields available, but in identifying companies capable of sustaining attractive dividend payments through various economic environments.

Successful high-yield dividend investing demands comprehensive analysis that examines dividend coverage ratios, cash flow sustainability, balance sheet strength, and competitive positioning. By applying these principles consistently and maintaining disciplined risk management practices, investors can construct portfolios that generate attractive income while preserving capital over time.

The dividend yield trap remains a constant threat, but informed investors who understand the warning signs and apply rigorous analysis can navigate these dangers successfully. Remember that sustainable dividends supported by strong business fundamentals will always outperform unsustainable yields that appear attractive but lack proper foundation.

Your journey toward dividend investing mastery continues with each company analyzed, each ratio calculated, and each investment decision made with Swiss precision and discipline. The rewards—both in terms of income generation and capital appreciation—justify the effort required to distinguish truly safe high-yield opportunities from the many pretenders competing for your investment capital.

In the elegant halls of Swiss wealth management, we understand that building lasting prosperity requires patience, discipline, and an unwavering commitment to quality over quick gains. Apply these principles to your high-yield dividend investing, and watch as your portfolio generates the sustainable income streams that form the foundation of true financial independence.