Picture the imposing granite facades of Wall Street’s financial titans, where behind mahogany boardroom tables, executives make decisions that ripple through global markets. As Asel, your Swiss wealth management guide, I’ve spent countless hours analyzing the US financial sector to identify the most promising dividend-paying banks that combine income generation with capital appreciation potential. Today, we’ll explore five exceptional financial dividend stocks that have emerged from 2025’s rigorous stress tests stronger than ever, ready to reward patient investors with growing income streams.

The financial sector has undergone a remarkable transformation in 2025, with dividend growth accelerating as banks benefit from higher interest rates, improved net interest margins, and strengthened balance sheets. Unlike previous years when technology stocks dominated returns, financial services companies have led market performance, with the sector gaining over 8% in the first quarter alone.

Why the Financial Sector Shines in 2025

The US financial sector has experienced a renaissance in 2025, driven by several powerful tailwinds that create an ideal environment for dividend investing. Interest rate stability has allowed banks to maintain wider net interest margins while managing funding costs effectively, directly translating into improved profitability and enhanced dividend coverage ratios.

Federal Reserve stress test results released in July 2025 showed unprecedented strength across the banking sector, with all 22 major banks passing the rigorous examinations. This regulatory approval opened the floodgates for dividend increases and share repurchase programs, signaling management confidence in sustained earnings power and capital generation capabilities.

Credit quality metrics have remained robust throughout 2025, with loan loss provisions staying well below historical averages despite economic uncertainties. This credit stability provides banks with the financial flexibility to return capital to shareholders through dividend payments while maintaining adequate reserves for potential future losses.

1. JPMorgan Chase (JPM): The Dividend Aristocrat in Waiting

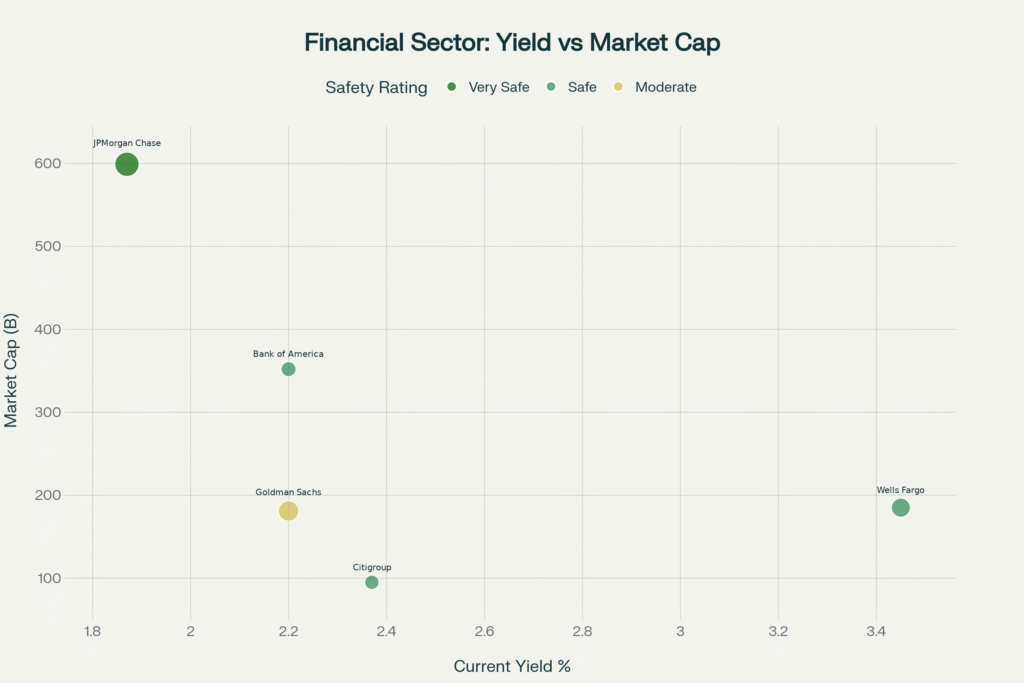

JPMorgan Chase stands as the undisputed king of US banking dividends, combining massive scale with disciplined capital management that generates consistent returns for shareholders. With a market capitalization exceeding $599 billion, JPM offers the financial stability that Swiss private banks demand when constructing client portfolios.

The bank’s current dividend yield of 1.87% may appear modest compared to smaller regional banks, but the underlying quality and growth trajectory more than compensate for the lower initial yield. JPM’s annual dividend of $5.60 per share represents a remarkable 20.4% increase from the previous year, demonstrating management’s commitment to returning capital to shareholders.

Dividend safety metrics for JPMorgan Chase rank among the strongest in the financial sector, with a conservative payout ratio of just 27%. This low payout ratio provides substantial cushion for maintaining dividends through economic downturns while creating room for future dividend growth as earnings continue expanding.

Earnings per share growth projections for JPM show continued strength, with analysts expecting sustained profitability driven by the bank’s diversified revenue streams spanning investment banking, asset management, and consumer banking. The bank’s return on equity consistently exceeds 15%, generating the profits necessary to support both dividend payments and business reinvestment.

2. Bank of America (BAC): The Steady Dividend Grower

Bank of America represents the epitome of dividend reliability in the US financial sector, with a 55-year streak of consistent dividend payments that survived multiple economic cycles. The bank’s recent announcement of an 8% dividend increase to $0.28 per share demonstrates continued confidence in earnings power and capital generation.

BAC’s dividend yield of 2.20% positions it attractively within the financial sector dividend landscape, offering meaningful income while maintaining conservative payout policies. The bank’s payout ratio of 31% provides ample coverage for dividend payments while retaining earnings for growth investments and regulatory capital requirements.

Stress test performance in 2025 showed Bank of America’s stress capital buffer improving to 2.5%, well above regulatory minimums and enabling increased capital distributions. This regulatory approval paved the way for both dividend increases and a new $40 billion share repurchase program, maximizing shareholder returns.

Net interest income stability has become a hallmark of BAC’s earnings profile, with the bank’s massive deposit base providing low-cost funding that supports healthy profit margins. This funding advantage creates a sustainable competitive moat that underpins long-term dividend sustainability and growth potential.

3. Wells Fargo (WFC): The Turnaround Dividend Story

Wells Fargo presents the most compelling dividend growth story among major US banks, with a 12.5% increase in quarterly dividends to $0.45 per share reflecting the bank’s operational turnaround and regulatory rehabilitation. The bank’s current yield of 3.45% ranks highest among the major money center banks, offering attractive income for dividend-focused investors.

Regulatory progress has been the key catalyst for Wells Fargo’s dividend restoration, with the bank’s stress capital buffer decreasing from 3.8% to 2.5% following successful completion of Federal Reserve examinations. This regulatory relief creates additional capacity for capital distributions while maintaining strong balance sheet metrics.

Operational efficiency improvements continue driving earnings growth at Wells Fargo, with the bank’s disciplined expense management and technology investments enhancing profitability. The bank’s payout ratio of 31% provides comfortable dividend coverage while allowing management flexibility to navigate changing market conditions.

Dividend safety at Wells Fargo has improved dramatically as the bank rebuilt its capital position and resolved outstanding regulatory issues. The combination of improved earnings, lower regulatory burdens, and strengthened risk management creates a foundation for sustained dividend growth over the coming years.

4. Citigroup (C): The High-Yield Transformation Play

Citigroup offers the most attractive dividend yield among global systemically important banks at 2.37%, combined with a compelling transformation story under CEO Jane Fraser’s leadership. The bank’s recent 7.1% dividend increase to $0.60 per share signals confidence in the ongoing business restructuring and capital optimization efforts.

Strategic simplification has become Citigroup’s defining characteristic, with the bank divesting non-core assets and focusing resources on higher-return businesses. This strategic focus enhances earnings quality and creates more predictable cash flows that support sustainable dividend payments.

Valuation attractiveness makes Citigroup particularly appealing for dividend investors, with the stock trading at just 10.98 times forward earnings despite maintaining strong capital ratios. This discount to peers creates potential for both dividend income and capital appreciation as the transformation story unfolds.

Payout ratio discipline at Citigroup has improved significantly, with the current 34% payout ratio providing adequate earnings retention for business investment while supporting competitive dividend yields. Analysts project the payout ratio declining to 29% over the next three years as earnings growth accelerates.

5. Goldman Sachs (GS): The Premium Dividend Provider

Goldman Sachs rounds out our selection with a unique value proposition combining investment banking expertise with increasingly diversified revenue streams that support growing dividend payments. The firm’s quarterly dividend of $4.00 per share represents significant absolute income for investors seeking exposure to premier financial services.

Earnings volatility has traditionally been Goldman’s challenge for dividend investors, but the firm’s expansion into consumer banking and asset management has created more stable revenue sources. This diversification supports more predictable cash flows that underpin sustainable dividend policies.

Return on equity at Goldman Sachs consistently ranks among the highest in the financial sector, generating the profits necessary to support both competitive dividend yields and business reinvestment. The firm’s ability to command premium fees across its business lines creates sustainable competitive advantages.

Capital allocation discipline has improved significantly at Goldman Sachs, with management balancing dividend payments, share repurchases, and business investments to maximize long-term shareholder value. The firm’s payout ratio of 26% provides flexibility to maintain dividends through market cycles while investing in growth opportunities.

Sector-Wide Trends Supporting Dividend Growth

Interest rate environment in 2025 continues favoring financial sector profitability, with net interest margins remaining elevated compared to the ultra-low rate environment of previous years. This interest rate stability creates predictable earnings that support sustainable dividend policies across the sector.

Regulatory clarity has improved significantly following completion of 2025 stress tests, with banks receiving approval for increased capital distributions. This regulatory support removes a major obstacle to dividend growth that constrained the sector in previous years.

Credit quality metrics remain healthy across the financial sector, with loan loss provisions staying well below historical averages despite economic uncertainties. This credit stability provides banks with confidence to maintain and grow dividend payments without compromising balance sheet strength.

Digital transformation investments are beginning to pay dividends across the financial sector, with improved operational efficiency and customer experience driving revenue growth and cost savings. These technology investments create sustainable competitive advantages that support long-term profitability and dividend sustainability.

Risk Considerations for Financial Sector Dividends

Economic sensitivity remains the primary risk factor for financial sector dividends, as banking profitability closely correlates with economic growth and credit demand. Investors should monitor economic indicators that could signal potential headwinds for banking earnings and dividend sustainability.

Regulatory changes pose ongoing risks to financial sector dividend policies, with banks subject to evolving capital requirements and stress testing standards. Changes in regulatory expectations could impact banks’ ability to maintain current dividend payout ratios or growth trajectories.

Interest rate risk creates both opportunities and challenges for banking dividends, with rising rates generally beneficial for net interest margins but potentially harmful for credit quality and loan demand. Investors should consider how different interest rate scenarios might affect their chosen financial sector holdings.

Competition from fintech companies and non-traditional financial service providers continues pressuring traditional banks’ profit margins and market share. This competitive pressure could impact long-term growth prospects and dividend sustainability for traditional financial institutions.

Key Takeaways

- JPMorgan Chase offers the strongest combination of dividend safety and growth potential with a 20.4% dividend increase and conservative 27% payout ratio.

- Bank of America provides dividend reliability with 55 years of consecutive payments and recent 8% increase approval.

- Wells Fargo presents the highest current yield at 3.45% combined with compelling turnaround potential following regulatory rehabilitation.

- Citigroup offers attractive valuation and transformation upside with a 2.37% yield and strategic simplification progress.

- Goldman Sachs delivers premium investment banking exposure with $4.00 quarterly dividends and diversified revenue streams.

Conclusion: Building Wealth Through Financial Sector Dividends

The US financial sector in 2025 represents a compelling opportunity for dividend investors seeking the combination of current income and long-term growth potential. These five dividend stocks have demonstrated their resilience through regulatory stress tests while positioning themselves for continued dividend growth as the economic environment remains supportive.

Swiss wealth management principles emphasize the importance of quality over yield, and these financial institutions exemplify this philosophy through their conservative payout ratios, strong dividend coverage, and proven ability to navigate economic cycles. Whether you prioritize JPMorgan’s stability, Wells Fargo’s yield, or Goldman’s growth potential, each offers unique advantages for dividend-focused portfolios.

As we look ahead, the financial sector’s dividend renaissance appears well-positioned to continue, supported by favorable interest rates, regulatory approval, and improving operational efficiency. By carefully selecting from these premier dividend-paying banks, investors can build lasting wealth while enjoying the steady income that makes dividend investing so attractive to discerning investors worldwide.

The journey toward financial independence through dividend investing requires patience, discipline, and careful stock selection—qualities that these five US financial sector leaders reward handsomely through their commitment to returning capital to shareholders. In our next post, we’ll explore “International Dividend Opportunities: Exploring European Dividend Champions“, where we’ll apply these same rigorous analysis principles to uncover dividend gems across European markets.