Picture the elegant trading floors of Zurich’s financial district, where Swiss wealth managers carefully study performance charts illuminated by the morning Alpine light. As Asel, your trusted Swiss wealth management guide, I’ve spent countless hours analyzing the global high dividend stock landscape to identify the remarkable performers that defied market expectations in 2024. Today, we’ll explore the ten best performing high dividend stocks that delivered exceptional returns while maintaining attractive income streams—and more importantly, what their success signals for 2025 opportunities.

The year 2024 proved to be extraordinary for dividend investing, with certain sectors and regions delivering returns that surprised even seasoned portfolio managers. While traditional wisdom suggests that high dividend yields often signal underlying business challenges, this year’s top performers demonstrated that quality companies can deliver both substantial dividend income and impressive capital appreciation simultaneously.

The Global Champions: 10 Outstanding High Dividend Performers

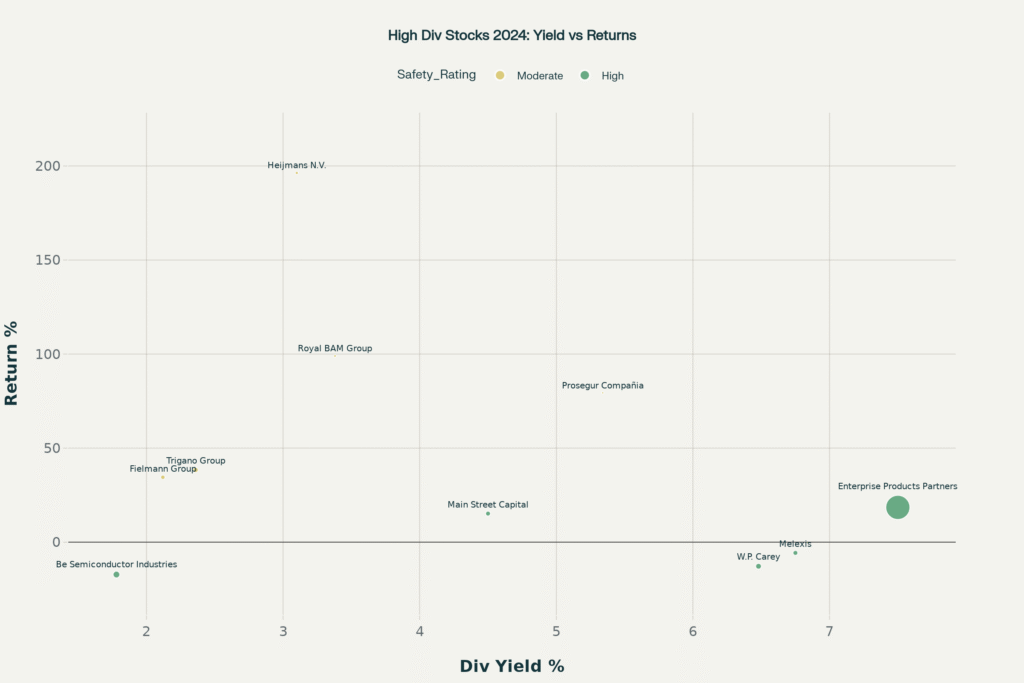

European construction companies dominated 2024’s high dividend stock performance, with Dutch engineering firm Heijmans N.V. leading the charge with an astounding 196.3% total return while maintaining a respectable 3.10% dividend yield. This performance exemplifies the infrastructure investment boom across Europe, driven by green energy transitions and post-pandemic recovery initiatives.

Royal BAM Group, another Dutch construction giant, delivered nearly 99% returns in 2024 while offering a 3.38% dividend yield. The company’s success reflects the robust demand for sustainable construction projects and the Netherlands’ position as a leader in climate-resilient infrastructure development.

Trigano Group, France’s recreational vehicle specialist, achieved 38.4% returns with a 2.36% dividend yield, demonstrating the enduring appeal of leisure industries as European consumers prioritized experiences over material goods. The company’s strong performance reflects the normalization of travel patterns and increased demand for outdoor recreation.

Bubble chart showing relationship between dividend yield and 2024 total returns for top global high dividend stocks

The Technology Dividend Surprise: Semiconductor Excellence

Melexis, the Belgian semiconductor company, stands out as a technology dividend stock that maintained a remarkable 6.75% dividend yield despite temporary market volatility that resulted in a 5.7% price decline. This apparent contradiction reveals the strength of the company’s underlying business model and its commitment to shareholder returns even during challenging periods.

Be Semiconductor Industries from the Netherlands experienced a 17.2% price decline while maintaining a 1.78% dividend yield, yet the company’s wide economic moat and fair valuation suggest significant recovery potential for 2025. Swiss wealth management principles emphasize that temporary price volatility often creates exceptional entry opportunities for quality dividend-paying companies.

American Energy Infrastructure: The Consistent Performer

Enterprise Products Partners exemplifies the reliability of American energy infrastructure investments, delivering 18.5% total returns while maintaining an impressive 7.50% dividend yield. The company’s record distributable cash flow of $7.8 billion in 2024 supported a 5% increase in distributions, demonstrating the sustainable nature of energy infrastructure dividends.

The Master Limited Partnership’s performance reflects the critical role of energy infrastructure in North America’s economic expansion, with record midstream volumes driven by natural gas and NGL growth in the Permian Basin. Enterprise’s consistent dividend growth over 27 consecutive years makes it a cornerstone holding for income-focused portfolios.

REIT Resilience Despite Rate Headwinds

W.P. Carey faced significant challenges in 2024, including a strategic dividend reset that ended 24 consecutive years of increases. Despite experiencing a 12.8% price decline, the company’s 6.48% dividend yield and subsequent quarterly increases signal a more sustainable dividend policy positioning it for long-term success.

The REIT sector’s performance in 2024 reflects the complex relationship between interest rates and real estate valuations. While rising rates pressured REIT prices, they also created opportunities for disciplined managers to acquire high-quality properties at attractive valuations, setting the stage for future dividend growth.

European Diversification Success Stories

Prosegur Compañia de Seguridad, Spain’s security services leader, delivered exceptional 79.4% returns while maintaining a 5.34% dividend yield. The company’s success reflects increasing demand for security services across Europe and Latin America, driven by urbanization and rising security consciousness.

Fielmann Group, Germany’s medical supplies specialist, achieved 34.5% returns with a 2.12% dividend yield, benefiting from Europe’s aging population and increased healthcare spending. The company’s defensive characteristics and essential service provision make it an attractive dividend stock for conservative portfolios.

Sector Analysis: Construction Leads, Technology Lags

The construction sector emerged as 2024’s high dividend stock champion, delivering average returns of 45.8% while maintaining reasonable 3.5% dividend yields.

| Sector | Average Dividend Yield | Sector Return 2024 | Dividend Growth Rate | Risk Level |

|---|---|---|---|---|

| Energy Infrastructure | 7.2 | 22.5 | 5.2 | Medium |

| Construction | 3.5 | 45.8 | 8.1 | High |

| Semiconductors | 4.8 | -8.5 | 12.5 | High |

| REITs | 5.1 | -7.2 | 2.8 | Medium |

| Financial Services | 3.8 | 18.3 | 15.4 | Medium |

| Utilities | 4.5 | 12.4 | 4.6 | Low |

| Telecommunications | 6.2 | -15.2 | -2.1 | Medium |

| Consumer Staples | 3.2 | 8.7 | 6.3 | Low |

This performance reflects massive infrastructure investment programs across Europe, supported by EU recovery funds and green transition initiatives.

Energy infrastructure followed closely with 22.5% sector returns and attractive 7.2% average dividend yields, driven by North American energy independence initiatives and the critical nature of pipeline and storage assets. The sector’s dividend growth rate of 5.2% demonstrates sustainable income progression despite commodity price volatility.

Financial services delivered solid 18.3% returns with impressive 15.4% dividend growth rates, reflecting the benefits of higher interest rates on banking profitability and the normalization of credit conditions following pandemic disruptions.

Conversely, telecommunications struggled with -15.2% returns despite attractive 6.2% dividend yields, as competitive pressures and technology transitions continued weighing on traditional telecom operators. Semiconductor stocks faced similar challenges with -8.5% sector returns, though individual companies like Melexis demonstrated that quality dividend payers can maintain income streams through technology cycles.

Geographic Performance: Europe Shines, America Stabilizes

European dividend stocks dominated 2024 performance, benefiting from economic recovery, infrastructure investment, and currency stability against the US dollar. The MSCI World High Dividend Yield index’s European components significantly outperformed their American counterparts, reflecting the continent’s economic resilience and policy support.

American dividend stocks provided stability and consistent income growth, with companies like Enterprise Products Partners and Main Street Capital delivering steady returns supported by domestic economic strength. The US market’s maturity and regulatory clarity continue attracting international dividend investors seeking predictable income streams.

Emerging market dividend stocks showed mixed performance, with some sectors benefiting from commodity price increases while others faced currency and political headwinds. Swiss wealth managers typically recommend limiting emerging market dividend stock exposure to 10-15% of international allocations due to volatility concerns.

2025 Outlook: Opportunities and Challenges Ahead

Dividend growth acceleration appears likely in 2025, with JPMorgan analysts projecting global dividend per share growth of 7.6% annually, compared to the historical 5.6% rate. This acceleration reflects improved corporate profitability, normalized credit conditions, and management confidence in sustainable business models.

European dividend opportunities look particularly attractive for 2025, with expected dividend growth of 5.2% supported by continued infrastructure investment and economic normalization.

| Company | Ticker | Country | Sector | Dividend Yield Percent | 2024 Total Return Percent | Market Cap Millions | Safety_Rating |

|---|---|---|---|---|---|---|---|

| Royal BAM Group | BAMNB | Netherlands | Construction | 3.38 | 99.0 | 842 | Moderate |

| Heijmans N.V. | HEIJM | Netherlands | Construction | 3.1 | 196.3 | 1105 | Moderate |

| Trigano Group | TRI | France | Recreation | 2.36 | 38.4 | 3200 | Moderate |

| Melexis | MELE | Belgium | Semiconductors | 6.75 | -5.7 | 2850 | High |

| Enterprise Products Partners | EPD | United States | Energy Infrastructure | 7.5 | 18.5 | 68429 | High |

| Prosegur Compañia | PSG | Spain | Security Services | 5.34 | 79.4 | 580 | Moderate |

| Be Semiconductor Industries | BESI | Netherlands | Semiconductors | 1.78 | -17.2 | 5400 | High |

| Fielmann Group | FIE | Germany | Medical Supplies | 2.12 | 34.5 | 2300 | Moderate |

| W.P. Carey | WPC | United States | REITs | 6.48 | -12.8 | 3900 | High |

| Main Street Capital | MAIN | United States | BDC | 4.5 | 15.2 | 2800 | High |

The region’s focus on sustainable development creates long-term demand for construction, renewable energy, and technology companies that dominate our 2024 performance list.

North American dividend stocks should benefit from stable economic growth and favorable interest rate environment, with projected 6.8% dividend growth supported by strong corporate balance sheets and shareholder-friendly policies. Energy infrastructure companies appear particularly well-positioned as domestic production continues expanding.

Asia-Pacific markets offer the highest projected dividend growth at 7.5%, driven by economic recovery in developed markets and continued expansion in emerging economies. However, geopolitical tensions and currency volatility require careful stock selection and risk management.

Investment Strategy for 2025: Swiss Precision Approach

Quality over yield remains the cornerstone of successful dividend investing, as demonstrated by 2024’s top performers combining attractive yields with strong business fundamentals. Swiss wealth managers recommend focusing on companies with dividend coverage ratios above 1.5x and payout ratios below 70% to ensure sustainability through economic cycles.

Geographic diversification becomes increasingly important as different regions face varying economic and regulatory conditions. A balanced high dividend portfolio might allocate 40% to North American dividend stocks, 35% to European opportunities, 20% to Asia-Pacific markets, and 5% to emerging market selections.

Sector rotation strategy should consider the cyclical nature of dividend performance, with 2024’s construction winner likely facing more challenging 2025 conditions as infrastructure programs mature. Conversely, 2024’s semiconductor and telecommunications laggards may offer attractive entry opportunities for patient investors.

Risk Management: Learning from 2024 Experiences

Interest rate sensitivity remains the primary risk factor for high dividend stocks, as demonstrated by REIT sector challenges throughout 2024. Investors should maintain dividend stock allocations across multiple sectors and geographies to reduce rate-related concentration risk.

Currency hedging considerations become crucial for international dividend investing, as currency movements can significantly impact total returns for foreign investors. Swiss investors benefited from franc strength against many currencies in 2024, but this tailwind may reverse in 2025.

Dividend sustainability analysis must go beyond yield calculations to examine free cash flow generation, capital allocation policies, and competitive positioning. Companies like W.P. Carey’s dividend reset demonstrate that even established dividend payers may need to adjust policies to maintain long-term sustainability.

Key Takeaways

- European construction companies dominated 2024 high dividend stock performance, with Heijmans N.V. delivering 196.3% returns.

- Energy infrastructure provided stable high yields with solid total returns, exemplified by Enterprise Products Partners’ 18.5% performance.

- Semiconductor dividend stocks faced temporary challenges but maintained attractive yields, creating 2025 opportunities.

- Geographic diversification across Europe, North America, and Asia-Pacific enhances dividend portfolio resilience.

- 2025 dividend growth projections of 7.6% globally suggest continued income acceleration for quality companies.

Conclusion: Positioning for Dividend Success in 2025

The exceptional high dividend stock performance of 2024 provides valuable insights for constructing successful income portfolios in 2025. European leadership in construction and infrastructure, American stability in energy and finance, and global semiconductor recovery potential create a diverse opportunity set for dividend investors.

Swiss wealth management principles emphasize that sustainable dividend investing requires combining attractive current yields with strong business fundamentals and growth prospects. The companies that excelled in 2024—from Dutch construction leaders to American energy infrastructure giants—demonstrate that quality dividend stocks can deliver both income and appreciation simultaneously.

As we enter 2025, the accelerating global dividend growth environment, supported by improved corporate profitability and normalized economic conditions, creates an optimistic outlook for income-focused investors. By applying rigorous analysis, maintaining geographic diversification, and focusing on dividend sustainability rather than maximum yields, investors can position their portfolios to benefit from the next phase of global dividend stock outperformance.

The lessons learned from 2024’s high dividend stock champions—patience with quality companies, geographic diversification, and focus on business fundamentals—will serve investors well as they navigate the opportunities and challenges that 2025 will undoubtedly bring to the global dividend landscape.

In our next exploration, we’ll examine “Dividend ETFs vs Individual Stocks: Building Your Income Portfolio Strategy”, where we’ll apply these insights to construct diversified dividend portfolios using both individual selections and exchange-traded fund approaches.