Main Takeaway: In today’s uncertain markets, building a reliable source of passive income is like assembling a finely tuned Swiss watch—each component must be precise, resilient, and work in harmony. By combining high yields, consistent payouts, and growth potential, you can create a dividend portfolio that stands the test of time.

A Story of the Alpine Climb

Imagine you are planning an ascent of the Matterhorn. You wouldn’t set off with only one piece of equipment—you would carefully select a rope, crampons, ice axe, and layers of clothing. Similarly, constructing a dividend portfolio means choosing a diverse set of stocks, each offering unique strengths: some provide sturdy income today, others promise dividend growth tomorrow.

As a Swiss wealth manager, I’ve guided clients through countless market peaks and valleys. My mantra is simple: steady progress beats chasing thrills. In this blog post, I’ll share the ten best Swiss dividend stocks to invest in right now, weaving in analogies from mountaineering and watchmaking to make these choices clear and actionable.

1. Zurich Insurance: The Sturdy Rope of Your Portfolio

When climbing, a reliable rope is non-negotiable. In the dividend world, Zurich Insurance Group fills that role with a 5.01% forward yield—the highest among Swiss blue chips—and three consecutive years of dividend increases. Its conservative payout ratio (around 91%) and robust balance sheet mean Zurich can support its income even if markets turn icy.

Key Attributes:

- Forward Yield: 5.01%

- Payout Ratio: 91%

- Dividend Growth: +4.2% annually (3-year average)

2. Nestlé: The Precision Gear

Swiss watches rely on precision gears to keep flawless time. Likewise, Nestlé S.A. provides precision in your income stream with a 4.16% yield and two decades of uninterrupted payouts. Nestlé’s consumer-defensive moat ensures steady cash flows, making it a cornerstone of any dividend portfolio.

Key Attributes:

- Forward Yield: 4.16%

- Payout Ratio: 65%

- Dividend Growth: +3.0% annually (3-year average)

3. Swiss Re: The Ice Axe for Safety and Traction

An ice axe provides security on steep slopes. Swiss Re AG acts similarly by offering a 4.43% yield, backed by global reinsurance expertise. A payout ratio of around 76% leaves room to grow dividends in prosperous years while maintaining strong reserves when conditions worsen.

Key Attributes:

- Forward Yield: 4.43%

- Payout Ratio: 76%

- Dividend Growth: +4.9% annually (3-year average)

4. Swisscom: The Climbers’ Layered Clothing

To endure alpine weather, climbers use layers. Swisscom AG is the telecom layer that adapts to market shifts, delivering a 3.86% yield with a consistent CHF 22 annual dividend. Its leading market position and strong free cash flow generation cushion against industry headwinds.

Key Attributes:

- Forward Yield: 3.86%

- Payout Ratio: 67%

- Dividend Growth: Stable CHF 22 payout

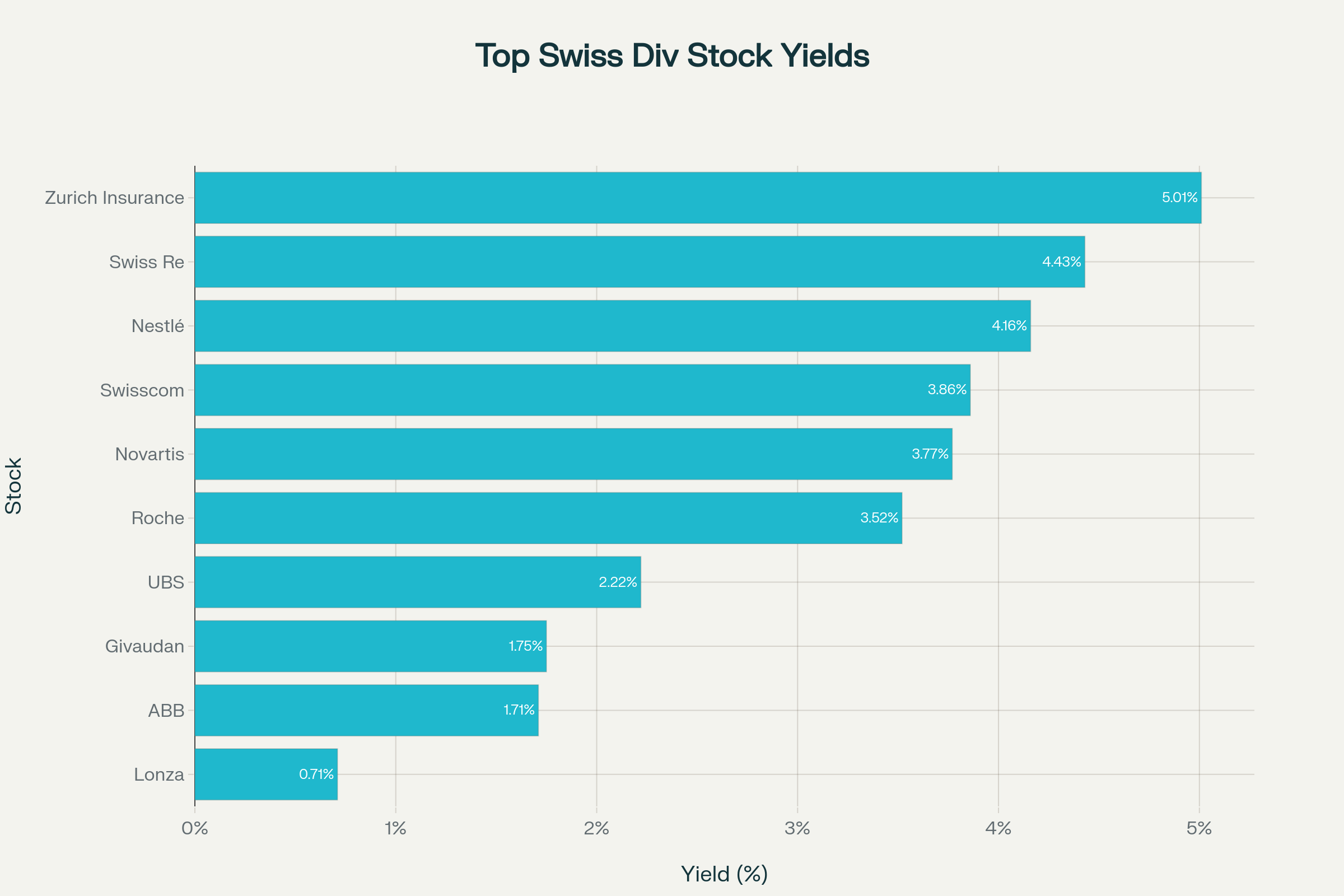

Dividend Yield Comparison

Below is a visual representation of the forward dividend yields for our ten peak performers. This chart shows the yield percentage for each stock, allowing you to quickly gauge income potential.

Forward Dividend Yields of 10 Best Swiss Dividend Stocks

5. Novartis: The Reliable Carabiner

A carabiner secures climbers in critical spots. Novartis AG, with a 3.77% yield, acts as that safety link for your portfolio. It has increased dividends for nearly 30 years and maintains a prudent payout ratio of about 80%, balancing generosity with sustainability.

Key Attributes:

- Forward Yield: 3.77%

- Payout Ratio: 80%

- Dividend Growth: +2.5% annually (3-year average)

6. Roche: The High-Precision Altimeter

An altimeter tells you exactly how high you’ve climbed. Roche Holding AG serves a similar role in measuring portfolio performance. Its 3.52% yield comes from 25 years of uninterrupted increases, underpinned by a nearly 94% payout ratio and strong oncology drug franchises.

Key Attributes:

- Forward Yield: 3.52%

- Payout Ratio: 94%

- Dividend Growth: +3.8% annually (3-year average)

7. UBS: The Basecamp Anchor

Before pushing higher, climbers establish a secure basecamp. UBS Group AG is your financial anchor, offering a 2.22% yield and a low payout ratio (46%) that leaves ample capital for reinvestment and future increases as cost synergies take effect.

Key Attributes:

- Forward Yield: 2.22%

- Payout Ratio: 46%

- Dividend Growth: Potential as integration synergies materialize

8. Givaudan: The Specialized Crampons

Specialty crampons grip unfavorable surfaces. Givaudan SA, the world’s largest flavors and fragrances company, yields 1.75%, but its specialized market niche and a 25-year dividend streak make it a reliable pick for long-term income growth.

Key Attributes:

- Forward Yield: 1.75%

- Payout Ratio: 50%

- Dividend Growth: +2.0% annually (3-year average)

9. ABB: The Versatile Backpack

A good backpack carries everything you need. ABB Ltd serves as a versatile industrial hold in your portfolio with a 1.71% yield. Its diversified electrical equipment business and 4.6% annual dividend growth rate balance modest income today with potential increases tomorrow.

Key Attributes:

- Forward Yield: 1.71%

- Payout Ratio: 60%

- Dividend Growth: +4.6% annually (3-year average)

10. Lonza: The Lightweight Shelter

A lightweight shelter protects you without weighing you down. Lonza Group AG, the biotech and specialty chemicals provider, offers a 0.71% yield, but with a low payout ratio (25%) and a remarkable 10.3% annual dividend growth rate, it promises higher income streams in future seasons.

Key Attributes:

- Forward Yield: 0.71%

- Payout Ratio: 25%

- Dividend Growth: +10.3% annually (3-year average)

Summary Table of Top 10 Swiss Dividend Stocks

| Stock | Forward Yield | Payout Ratio | 3-Year Dividend Growth |

|---|---|---|---|

| Zurich Insurance | 5.01% | 91% | +4.2% |

| Nestlé | 4.16% | 65% | +3.0% |

| Swiss Re | 4.43% | 76% | +4.9% |

| Swisscom | 3.86% | 67% | Stable CHF22 |

| Novartis | 3.77% | 80% | +2.5% |

| Roche | 3.52% | 94% | +3.8% |

| UBS | 2.22% | 46% | Potential to grow |

| Givaudan | 1.75% | 50% | +2.0% |

| ABB | 1.71% | 60% | +4.6% |

| Lonza | 0.71% | 25% | +10.3% |

Crafting Your Dividend Expedition

Just as you wouldn’t climb the Matterhorn without planning, don’t build your dividend portfolio on a whim. Here’s how to approach your ascent:

- Assess Your Risk Tolerance: Insurance and consumer staples offer defense on steep slopes (Zurich, Nestlé), while industrials and biotech (ABB, Lonza) can propel growth but require stronger stomachs.

- Define Income Needs vs. Growth Ambitions: If you seek immediate cash flow, prioritize high-yield names like Zurich and Swiss Re. If you’re in for the long haul, lean into Lonza and ABB for future payout expansion.

- Rebalance Seasonally: Like checking gear at basecamp, review your holdings quarterly. Adjust weightings if yields dip or growth momentum shifts.

- Diversify Across Sectors: Spread risk—combine insurers, healthcare, consumer staples, telecom, financials, industrials, and specialty chemicals to avoid sector-specific avalanches.

- Monitor Payout Ratios: A payout ratio above 90%, as with Roche, demands close monitoring to ensure dividends remain sustainable.

Key Takeaways

- High-Yield Anchors: Zurich Insurance (5.01%), Swiss Re (4.43%), and Nestlé (4.16%) deliver robust income.

- Growth-Focused Climbers: Lonza (10.3% growth) and ABB (4.6% growth) may boost future yields.

- Balanced Expedition: Combining defensive stalwarts (Novartis, Roche) with cyclical names (ABB, UBS) smooths the ascent.

- Diversification is Essential: No single stock secures the summit—build a multi-sector portfolio.

- Regular Checkpoints: Reassess positions quarterly to adapt to market conditions.

Conclusion: Preparing for the Next Peak

Constructing a dividend portfolio is much like alpine mountaineering: success hinges on meticulous planning, quality equipment, and disciplined execution. By integrating these ten Swiss giants, you align yield, stability, and growth—essential for a smooth ascent to your financial summit.

Stay tuned for my next post, where we’ll explore “How to Construct a Swiss Dividend Portfolio for Long-Term Passive Income,” detailing position sizing, tax considerations, and rebalancing strategies to keep you firmly on the path to financial freedom.