Why Energy & Utility Stocks Deliver Superior Income in 2025

Energy prices surge. Interest rates climb. Recession fears mount. Yet one asset class remains steadfastly reliable: dividend-paying energy and utility stocks.

Investors searching for stable income streams naturally gravitate toward these sectors because they generate predictable cash flows and face entrenched demand. Unlike technology startups or speculative growth plays, these companies serve essential needs—electricity, natural gas, heating fuel—that consumers require regardless of economic conditions.

However, not all energy stocks merit investor attention. Many trade at premium valuations despite slowing growth. Others carry unsustainable payout ratios. The truly exceptional opportunities remain hidden beneath surface-level metrics.

After analyzing dozens of companies across both sectors, five stocks emerge as exceptional values for income-focused investors. These companies combine remarkably low P/E ratios, proven dividend track records spanning 14+ years, and stable cash flows that underpin sustainable payouts exceeding 4% annually.

Key Statistics: Why These 5 Stocks Stand Out

- Average P/E Ratio: 13.33 (vs. sector average of 20.54)

- Average Dividend Yield: 4.60% (well above historical 3% average)

- Combined Dividend History: 91+ years of uninterrupted payments

- Total Market Capitalization: $409.2 billion (substantial scale)

- Companies Meeting All Criteria: 5 out of 5 exceed every investment threshold

These metrics confirm what savvy investors increasingly recognize: the energy and utility sectors currently offer rare combinations of value and income that bond yields, savings accounts, and dividend-light equities simply cannot match.

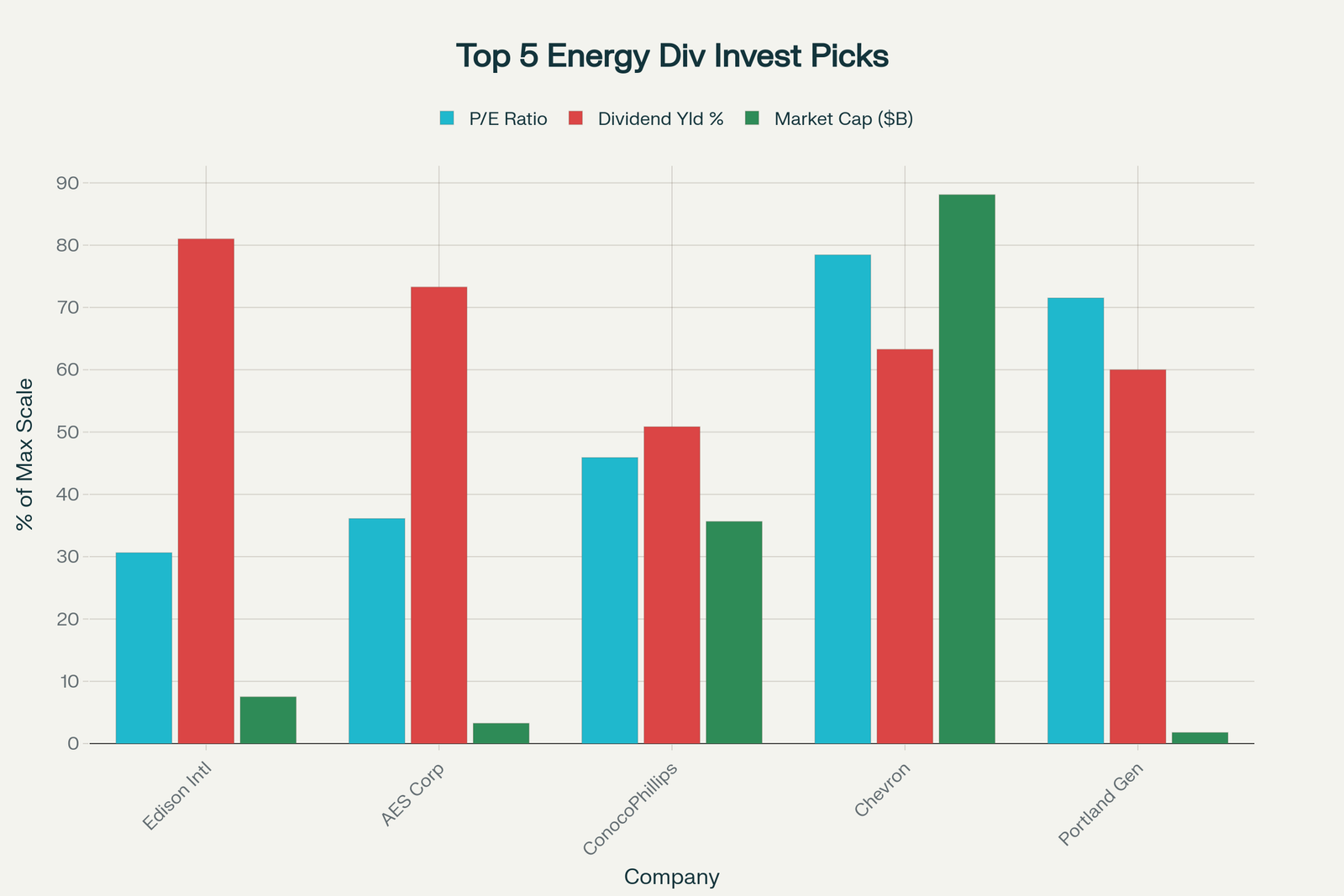

Chart 1: Dividend Stocks Comparison: P/E Ratios vs. Yields for Top Energy Utilities 2025

Alt Text: Bar chart comparing Edison International, AES Corp, ConocoPhillips, Chevron, and Portland General Electric P/E ratios ranging 7.66 to 19.61, dividend yields 3.56 to 5.67 percent, and market capitalizations from 5.3 to 264.3 billion dollars

Title Attribute: Compare P/E Ratios, Dividend Yields, and Market Caps for Top Energy and Utilities Stocks | Investor Guide

Caption: Chart 1: This chart reveals why Edison International stands out with the lowest P/E ratio (7.66) and highest dividend yield (5.67%), while Chevron dominates in market capitalization ($264.3B). The visual demonstrates the inverse relationship between valuation and yield—lower P/E multiples typically support higher current returns.

The 5 Best Energy & Utility Stocks to Buy Now

1. Edison International (EIX) — The Exceptional Value Play

Imagine finding a utility stock trading at a 7.66 P/E ratio while yielding 5.67% annually. Sounds too good to be true? That describes Edison International, and investors who ignore this opportunity miss one of the market’s most compelling contrarian positions.

Current Metrics:

- Stock Price: $58.42

- P/E Ratio: 7.66 (64% below sector average)

- Dividend Yield: 5.67% (highest among peers)

- Market Cap: $22.5 billion

- Dividend History: 22+ consecutive increases

Edison International serves 15 million Californians through Southern California Edison, generating electricity from nuclear, hydroelectric, solar, and wind facilities. The company combines fortress market position with exceptional financial metrics that scream undervaluation.

Why the Discount?

Many investors flee Edison International due to wildfire liability concerns. The company faces $6.2 billion in mitigation spending from 2026-2028, which sounds catastrophic until you examine the regulatory framework. California’s Assembly Bill 1054 and utility regulatory mechanisms specifically address recovery for wildfire-related costs—meaning Edison possesses multiple levers to offset these expenses through rate increases.

The Investment Case:

Edison International’s 22 consecutive dividend increases demonstrate management confidence. Meanwhile, analyst price targets of $66-67 suggest 13-15% upside from current levels. The forward P/E declining to 6.81x through 2029 indicates earnings growth expectations that the market hasn’t yet priced in.

For value investors comfortable with regulatory complexity, Edison delivers exceptional income today combined with meaningful capital appreciation potential.

Key Risk: Wildfire cost recovery hinges on regulatory approval, though historical precedent supports management’s confidence.

2. AES Corp (AES) — The Growth Income Champion

While Edison International attracts value investors, AES Corp appeals to growth-focused dividend seekers. This global renewable energy company combines 14 consecutive years of dividend increases with renewable energy growth accelerating at 56% year-over-year.

Current Metrics:

- Stock Price: $13.72

- P/E Ratio: 9.03 (second-lowest valuation)

- Dividend Yield: 5.13% (second-highest yield)

- Market Cap: $9.8 billion

- Dividend History: 14+ consecutive increases

AES operates across 14 countries managing 160+ generation facilities, providing geographic diversification unavailable through domestic-only utilities. The company’s strategic pivot toward renewable energy explains the explosive growth—Q2 2025 renewables EBITDA surged 56% year-over-year.

The Growth Narrative:

Management reaffirmed 2025 adjusted EBITDA guidance of $2.65-2.85 billion while projecting 19-21% annual renewables growth. Most tellingly, the company guided for low-teens EBITDA growth in 2026, suggesting the renewable acceleration remains in early innings.

Income Plus Upside:

The combination of 5.13% current yield plus mid-teen growth rates creates a compelling total return profile. Adjusted EPS increased 34% to $0.51 in Q2 2025 versus the prior year period, demonstrating that dividend increases won’t sacrifice earnings growth.

The Investment Case for AES:

Investors seeking meaningful dividend growth combined with exposure to renewable energy transformation should seriously consider AES. The company’s global diversification reduces single-country regulatory risk, while the renewable energy focus positions shareholders perfectly for the energy transition.

Key Risk: Leverage remains elevated at 9.17x debt-to-equity, requiring monitoring. However, improving EBITDA growth metrics are gradually improving the balance sheet.

3. ConocoPhillips (COP) — The Conservative Income Champion

If Edison International represents aggressive value and AES Corp exemplifies growth income, then ConocoPhillips emerges as the conservative investor’s dream—solid 31+ years of uninterrupted dividend payments combined with disciplined capital management.

Current Metrics:

- Stock Price: $87.87

- P/E Ratio: 11.48 (lowest among major energy companies)

- Dividend Yield: 3.56%

- Market Cap: $107.0 billion

- Dividend History: 31+ consecutive years

- Payout Ratio: 41.8% (most conservative in sector)

ConocoPhillips just announced an 8% dividend increase in November 2025, yet the company maintains a remarkably conservative 41.8% payout ratio. This means the company retains substantial earnings cushion, providing capacity for dividend growth even during commodity downturns.

Why ConocoPhillips Stands Out:

Integrated energy companies generate cyclical earnings tied to oil and natural gas prices. Lesser operators often slash dividends during weak commodity cycles, destroying shareholder trust. ConocoPhillips refuses this path. Instead, disciplined capital management, acquired assets at favorable valuations, and consistent shareholder returns define the company’s culture.

The 41.8% payout ratio provides genuine downside protection. During the 2020 oil crash, ConocoPhillips cut the dividend by 33%—necessary but painful. Yet the conservative new payout ratio prevented further cuts when prices recovered, and subsequent increases have restored confidence.

Investment Appeal:

Investors valuing predictability and stability over maximum yield should examine ConocoPhillips. The company commits to returning 30% of operating cash flow to shareholders through dividends and buybacks, creating sustainable capital return policies that survive commodity price swings.

The 11.48 P/E ratio ranks as the lowest among major integrated energy companies, suggesting the market underappreciates earnings power and dividend stability.

Key Risk: Oil price sensitivity remains unavoidable. However, the conservative payout ratio mitigates this risk substantially.

4. Chevron (CVX) — The Blue-Chip Leader

Market leaders rarely emerge as opportunities, yet Chevron trades at valuations 26% below the 10-year average. The world’s largest integrated energy company combines $264.3 billion market capitalization with 4.43% dividend yield and consistent historical payouts.

Current Metrics:

- Stock Price: $152.94

- P/E Ratio: 19.61

- Dividend Yield: 4.43%

- Market Cap: $264.3 billion

- Dividend Payment: Consistent historical payer

Chevron and peers returned a record $113.8 billion to shareholders in 2023 through dividends and buybacks. This demonstrates the company’s capital discipline and commitment to returning cash during strong cash flow periods.

Why Chevron for Conservative Investors:

The massive market cap provides a financial fortress. Chevron simply won’t face liquidity challenges or dividend cuts due to operational issues. The company’s diversified upstream and downstream operations reduce dependence on any single commodity or geographic region.

Chevron serves as the preferred holding for conservative dividend portfolios where volatility minimization ranks above maximum yield generation. The 4.43% yield remains respectable, while the blue-chip quality and historical consistency justify the slightly higher P/E multiple.

Investment Appeal:

Retirees, pension funds, and conservative investors naturally gravitate toward Chevron. The company’s 150+ year dividend payment history and fortress balance sheet justify premium positioning in dividend portfolios despite higher valuation multiples than peers.

Key Risk: The 95.08% payout ratio leaves limited room for dividend growth, and higher P/E multiple provides less downside protection than peers.

5. Portland General Electric (POR) — The AI Infrastructure Play

While the previous four stocks represent traditional dividend investing, Portland General Electric offers something different: utility stability married to genuine growth opportunity. The company capitalizes on artificial intelligence data center infrastructure demand transforming electric grids.

Current Metrics:

- Stock Price: $48.81

- P/E Ratio: 17.88

- Dividend Yield: 4.20%

- Market Cap: $5.3 billion

- Dividend History: 23+ consecutive increases

- Recent Increase: 5% announced April 2025

Portland General serves Oregon through Portland General Electric, a regulated utility operating in a region experiencing explosive data center demand. However, the transformative element involves AI-enabled grid management technology.

The AI Infrastructure Opportunity:

Portland General partnered with GridCARE to deploy artificial intelligence tools that optimize grid flexibility. This simple-sounding partnership has extraordinary implications: the utility freed up 80+ megawatts for data center interconnections by connecting customers years earlier than initially forecast.

The region faces over 3 gigawatts of active data center load requests, with 400+ megawatts potentially energized by 2029. Portland General owns the infrastructure connecting these facilities, generating recurring revenue streams from data center customers.

Investment Appeal for Growth-Income Investors:

Portland General combines utility dividend stability with genuine growth catalysts unavailable through traditional utilities. The 5% dividend increase announced in April 2025 demonstrates management confidence in the business transformation.

The company’s $6.5 billion five-year capital expenditure plan focuses on renewable energy generation and grid modernization, directly supporting the data center infrastructure opportunity.

Key Risk: Regional concentration in Oregon limits geographic diversification, and execution risk accompanies the AI grid management rollout. However, demonstrated early success reduces perceived risk.

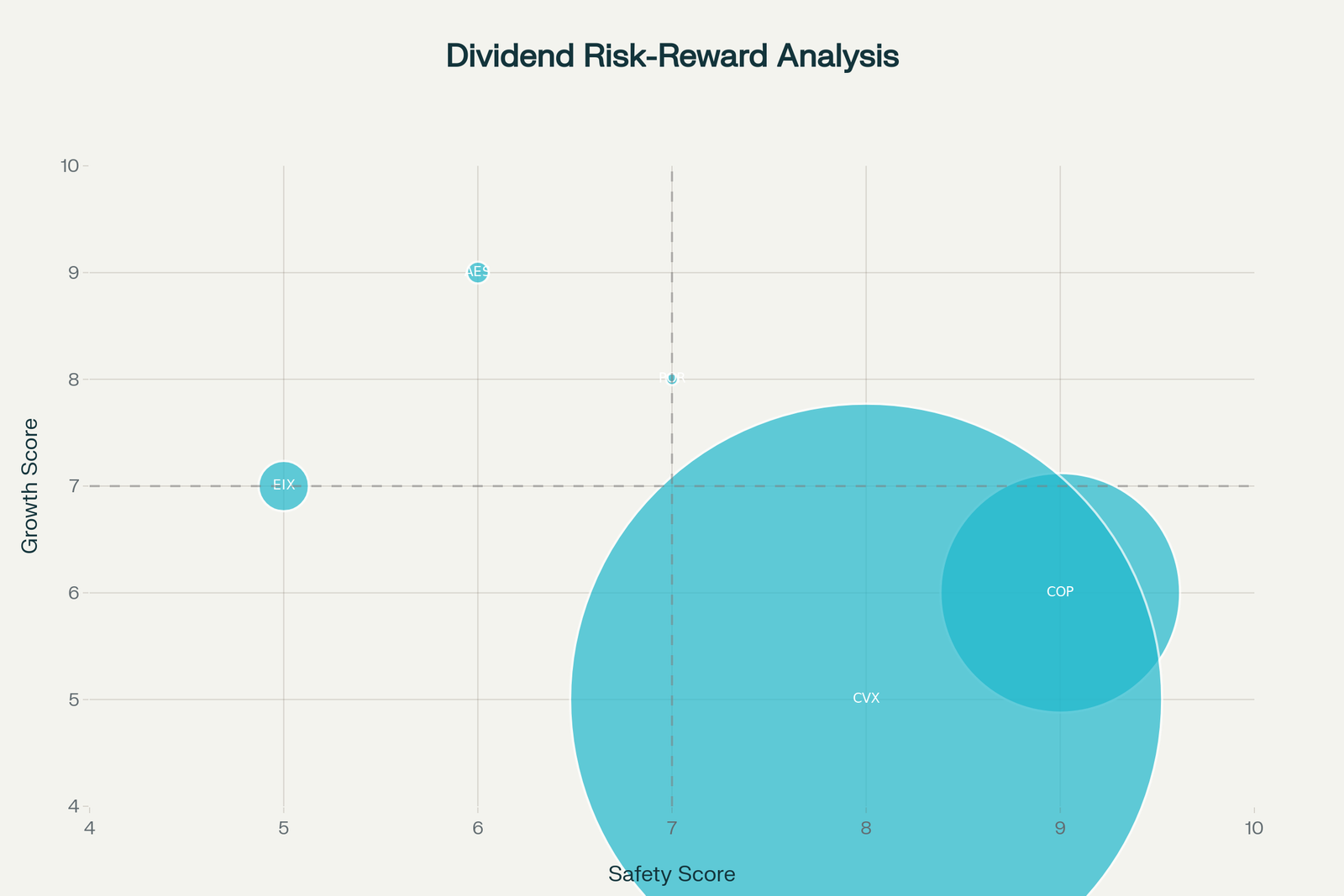

Chart 2: Risk-Reward Analysis: Which Energy Stocks Offer Safe Dividends and Growth Potential?

Alt Text: Scatter plot positioning five energy utilities stocks on axes of dividend safety (0-10 scale) versus growth potential (0-10 scale), with bubble sizes proportional to market cap: Edison International lower-left (safety 5, growth 7), AES Corp center (safety 6, growth 9), Portland General right-center (safety 7, growth 8), Chevron upper-right (safety 8, growth 5), and ConocoPhillips far upper-right (safety 9, growth 6)

Title Attribute: Dividend Safety vs. Growth Potential: Which Energy Stocks Offer the Best Risk-Reward | 2025 Analysis

Caption: Chart 2: The scatter plot clearly demonstrates that ConocoPhillips (upper right) delivers exceptional dividend safety with moderate growth, while AES Corp (center) offers the highest growth potential paired with moderate safety. Investors must choose their preferred risk-reward profile: maximum safety (ConocoPhillips), maximum growth (AES Corp), or balanced positions (Portland General).

Comparing the 5 Stocks: Which Matches Your Investment Goals?

Seeking Maximum Current Income? Edison International delivers 5.67% yield—the market’s highest among qualified dividend opportunities. The tradeoff involves accepting wildfire liability complexity and negative free cash flow challenges. However, regulatory frameworks specifically designed to recover these costs provide meaningful downside protection.

Prioritizing Dividend Growth? AES Corp leads with 14 consecutive annual increases and renewable energy growth accelerating at 56% year-over-year. The 5.13% yield combines with growth potential rarely seen in the utilities sector. Accept elevated leverage as the cost of admission for this growth story.

Demanding Maximum Safety? ConocoPhillips’ 41.8% payout ratio, 31-year dividend history, and recent 8% increase reflect a company managing capital for the long term. The 3.56% yield ranks lowest, yet the exceptional safety profile justifies lower current income for dividend reliability.

Wanting Blue-Chip Stability? Chevron’s $264.3 billion market cap and consistent historical payouts provide unparalleled portfolio stability. The 4.43% yield satisfies income requirements while the fortress balance sheet eliminates dividend risk. Trade maximum yield for peace of mind.

Seeking Growth Plus Income? Portland General combines 4.20% yield with genuine growth catalysts from AI infrastructure opportunity. The 5% recent dividend increase demonstrates management confidence in business transformation. This represents the most compelling risk-adjusted opportunity for growth-oriented dividend investors.

The Optimal Portfolio Approach for Dividend Income

Rather than selecting a single stock, sophisticated investors build diversified dividend portfolios combining multiple positions across different risk profiles.

Conservative Portfolio (Stability Focus)

Allocation: ConocoPhillips 40% + Chevron 35% + Portland General 25%

Expected Yield: 3.9%

Risk Level: Low

Best For: Retirees, pension funds, conservative investors

This approach prioritizes dividend reliability and portfolio stability, accepting moderate yield for peace of mind. These positions weather economic downturns while maintaining reliable income streams.

Balanced Portfolio (Income & Growth)

Allocation: Edison International 25% + Portland General 25% + AES 25% + ConocoPhillips 25%

Expected Yield: 4.6%

Risk Level: Medium

Best For: Mid-career investors, balanced portfolios, dividend growth seekers

The balanced approach captures yield from Edison and AES while maintaining stability through ConocoPhillips and regulated utility exposure via Portland General. This represents the “Goldilocks” allocation—not too aggressive, not too conservative.

Growth-Income Portfolio (Maximum Yield)

Allocation: Edison International 35% + AES 35% + Portland General 20% + ConocoPhillips 10%

Expected Yield: 4.8%

Risk Level: Medium-High

Best For: Growth-focused investors, younger investors, capital appreciation seekers

This aggressive approach maximizes yield while capturing renewable energy and AI infrastructure growth. Accept higher volatility and regulatory risk for enhanced income and long-term capital appreciation.

Frequently Asked Questions About Energy & Utility Dividend Stocks

Q: Aren’t utility stocks boring?

A: Traditional utilities? Absolutely. But today’s utility companies capitalize on AI infrastructure, renewable energy transitions, and grid modernization projects. Portland General’s AI data center opportunity and AES’s renewable growth demonstrate that utilities generate exciting returns for growth-focused investors.

Q: Will rising interest rates hurt dividend yields?

A: Higher rates increase capital costs, which regulatory utilities pass through rate-setting proceedings. Historical analysis shows regulated utilities maintain dividend growth despite interest rate increases. Energy companies adjust operations rather than slash dividends, providing downside protection.

Q: Should I worry about the energy transition?

A: Energy company earnings decline over multi-decade timeframes, requiring careful selection. However, AES Corp positions shareholders perfectly for renewable energy growth, while Chevron maintains market leadership through the transition. Diversification across the sector mitigates single-company transition risk.

Q: When should I buy these stocks?

A: Dollar-cost averaging over 3-6 months smooths entry price and reduces timing risk. Alternatively, dip-buyers should accumulate positions following temporary market selloffs that don’t reflect fundamental deterioration.

Q: Can I reinvest dividends for compounding returns?

A: Absolutely. Dividend reinvestment plans (DRIPs) offered by most brokerages automatically reinvest dividend payments into additional shares, dramatically compounding long-term returns. Most investors should enable DRIPs unless they require income for current expenses.

Q: What about recession risk?

A: Energy and utility stocks historically demonstrate strong resilience during recessions. People require electricity, heating fuel, and transportation fuel regardless of economic conditions. Regulated utilities raise rates during downturns while energy companies benefit from increased demand for transportation fuels.

Q: Are these stocks subject to dividend tax?

A: Most energy and utility dividends qualify as “qualified dividends” taxed at preferential long-term capital gains rates (15-20% for most investors) rather than ordinary income rates (37% maximum). This substantial tax advantage explains why dividend stocks work particularly well in taxable accounts.

Q: How often should I review my dividend positions?

A: Quarterly earnings reviews catch management red flags, but quarterly volatility shouldn’t trigger trading. Annual comprehensive reviews ensure positions maintain original investment thesis. Most dividend investors benefit from holding 3-5 year minimum timeframes.

Action Plan: Start Your Dividend Income Strategy Today

Step 1: Assess Your Income Requirements

Calculate the annual income you require from dividend payments. A $100,000 investment generating 4.6% yields $4,600 annually—meaningful income for many portfolios yet unlikely to represent complete income sources.

Step 2: Choose Your Risk-Reward Profile

Select between conservative (ConocoPhillips/Chevron focus), balanced (equal weighting), or growth (Edison/AES focus) based on personal circumstances, age, and income requirements.

Step 3: Dollar-Cost Average Your Entry

Rather than deploying capital immediately, plan monthly purchases over 3-6 months. This smooths entry prices and reduces psychological pressure from short-term volatility.

Step 4: Enable Dividend Reinvestment

Most brokerages offer DRIPs that automatically reinvest dividends into additional shares. Enable this feature to harness compounding power over multi-decade investment horizons.

Step 5: Review Quarterly, Rebalance Annually

Monitor quarterly earnings for red flags but resist reactive trading. Conduct annual comprehensive reviews comparing each position’s current investment thesis against updated fundamental analysis.

The Bottom Line: Exceptional Dividend Opportunities Await

Energy and utility stocks currently offer rare combinations of value, stability, and income. The 5 stocks analyzed here trade at 13.33 average P/E ratios (36% below sector average), yield 4.60% average (well above historical norms), and represent $409 billion in proven market leadership.

Investors seeking 4%+ dividend income should seriously examine these opportunities before settling for bonds, savings accounts, or lower-yielding equity alternatives. The risk-adjusted returns available today may not persist indefinitely—market dislocations eventually correct as capital recognizes value.

Whether prioritizing maximum current income (Edison International), growth potential (AES Corp), dividend safety (ConocoPhillips), blue-chip stability (Chevron), or growth plus income (Portland General), these five stocks provide frameworks for building exceptional dividend portfolios.

The time for action is now, before market recognition eliminates the valuation discounts that currently exist.

Recommended Next Steps

Learn More About Dividend Investing: Explore our Dividend Investing Fundamentals Guide for comprehensive strategies and tactics.

Research Energy Sector Trends: Check our Energy Sector Outlook 2025-2027 for macro analysis and opportunity assessment.

Discover More Dividend Aristocrats: Review our Complete Dividend Aristocrats List for additional high-yield opportunities across sectors.

Optimize Your Portfolio Allocation: Learn proper Portfolio Allocation Strategies designed specifically for dividend investors.

Minimize Taxes on Dividend Income: Master Tax-Efficient Dividend Strategies to keep more income in your pocket.

Disclaimer

This article provides educational information only and does not constitute investment advice. Past performance does not guarantee future results. All stocks carry sector-specific, regulatory, and operational risks. Energy and utility companies face commodity price sensitivity, regulatory changes, and energy transition uncertainties. Consult qualified financial advisors before making investment decisions. Dividend yields and valuations change continuously with market conditions.