Dividend investing isn’t about following a single rulebook. Instead, it’s about choosing a strategy—or a combination of strategies—that matches your financial goals, risk tolerance, and time horizon. Some investors want reliable growth that compounds quietly in the background, while others prefer higher income today.

Below, I’ll walk you through the most common dividend strategies, their pros and cons, and how they can fit into a well-balanced portfolio.

1. Dividend Growth Investing (DGI)

Dividend Growth Investing focuses on companies that consistently increase their dividends year after year. These companies—often called Dividend Aristocrats (25+ years of dividend growth) or Dividend Kings (50+ years)—signal financial strength and long-term stability.

Why investors love this strategy:

- Growing income: Your dividend payments rise over time, helping offset inflation.

- Financial quality: Firms that raise dividends consistently are usually strong and disciplined.

- Compounding effect: Higher dividends reinvested accelerate long-term wealth.

Best for: Long-term investors who prioritize sustainable growth over quick wins.

👉 Read more: Guide to Dividend Growth Investing

2. High-Yield Dividend Investing

High-Yield Investing focuses on companies that pay above-average dividends. Examples include Real Estate Investment Trusts (REITs), utilities, or certain financial firms. The main appeal here is cash flow today.

However, investors need to be careful: high yields sometimes signal trouble ahead. If a company pays out more than it earns, those dividends may not last.

Why investors choose this strategy:

- Immediate income: Attractive for retirees or income-focused investors.

- Cash flow flexibility: Dividends can be spent or reinvested.

- Sector exposure: Some high-yield areas (like real estate) diversify your portfolio.

Risks: Dividend “traps” where unsustainable payouts eventually get cut.

👉 Read more: Spotting Safe High-Yield Stocks

3. Dividend Reinvestment (DRIP)

Dividend Reinvestment Plans (DRIPs) allow you to automatically reinvest dividends into new shares instead of taking them as cash. Over time, this creates a powerful snowball effect.

Imagine:

- Your shares pay dividends.

- Dividends buy more shares.

- Those new shares also pay dividends.

This cycle compounds your returns significantly over the years.

Why investors love DRIPs:

- Hands-off investing: Everything is automatic.

- Faster growth: Reinvesting boosts compounding power.

- Discipline: You avoid the temptation of spending dividends prematurely.

Best for: Long-term investors who don’t need income today but want to maximize growth tomorrow.

👉 Read more: The Compounding Power of DRIPs

4. Dividend ETFs

Dividend-focused Exchange-Traded Funds (ETFs) are ideal if you want dividend exposure without picking individual stocks. They hold dozens or even hundreds of dividend-paying companies in one fund, which reduces single-company risk.

Why ETFs work well:

- Diversification: Spread risk across multiple companies.

- Simplicity: Perfect for beginners.

- Accessibility: Easy to buy and manage through most brokerages.

Trade-offs: You give up control over individual stock selection and pay a small management fee.

👉 Read more: Best Dividend ETFs for Income

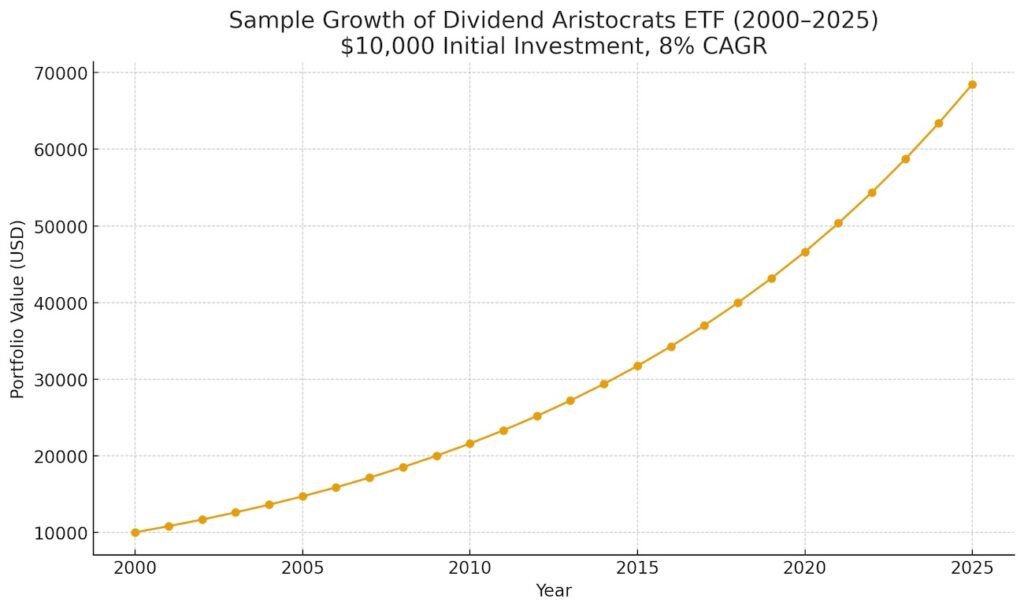

Real Example: Dividend Aristocrats Growth

To show the power of consistency, let’s look at how an investment in a Dividend Aristocrats ETF might have performed over the past 25 years.

If you invested $10,000 in 2000, reinvested dividends, and achieved an 8% average annual return, here’s what your portfolio could look like today:

Explanatory Notes:

While real returns vary year to year, the long-term trend shows how dividend investing rewards patience and consistency.

By 2025, your $10,000 would have grown to around $68,500.

This example assumes dividends were reinvested every year, which amplifies growth through compounding.

Strategy Comparison

| Strategy | Best For | Benefits | Risks | Time Horizon |

|---|---|---|---|---|

| Dividend Growth Investing | Long-term wealth builders | Rising income, inflation protection, quality companies | Lower starting yield | 10+ years |

| High-Yield Investing | Income-focused investors | High cash flow, short-term income | Dividend traps, volatility | Short to medium-term |

| Dividend Reinvestment (DRIP) | Growth-focused investors | Accelerated compounding, discipline | Less liquidity | Long-term |

| Dividend ETFs | Beginners & passive investors | Diversification, simple to manage | Limited control, fees | Any horizon |

Final Thoughts

There’s no single “best” dividend strategy. The smartest investors choose the approach—or combination—that fits their goals. Some build a core of dividend growth stocks, add a few high-yield names for income, and use a DRIP or ETF to simplify their journey.

The key takeaway? Dividend investing is not about timing the market, but about time in the market. Patience, reinvestment, and discipline are what truly drive long-term wealth.