Standing in the mahogany-paneled library of a centuries-old Swiss private bank, surrounded by leather-bound volumes documenting generations of wealth management wisdom, I often reflect on how dividend terminology forms the foundation of successful income investing. As Asel, your Swiss wealth management guide, I’ve observed that mastering the language of dividends transforms novice investors into sophisticated wealth builders who speak fluently with financial advisors, analyze investment opportunities with precision, and make informed decisions that compound wealth over decades.

The journey from dividend confusion to dividend mastery begins with understanding that dividend investing possesses its own sophisticated vocabulary—a financial lexicon that separates informed investors from those who stumble through investment decisions based on incomplete knowledge. Today, we’ll decode this essential terminology, transforming complex concepts into practical wisdom you can apply immediately to enhance your investment success.

The Foundation: Core Dividend Calculations Every Investor Must Master

Dividend yield represents the cornerstone metric that every dividend investor must understand completely. This fundamental calculation—annual dividend per share divided by current stock price—reveals the income return percentage you receive from your investment. When Swiss private banks evaluate dividend opportunities for their clients, dividend yield serves as the primary screening criterion.

Consider a practical example: Nestlé trading at CHF 100 per share with annual dividends of CHF 3.20 generates a dividend yield of 3.2%. This calculation immediately tells you that every CHF 1,000 invested produces CHF 32 in annual dividend income, providing a clear basis for comparing income-generating potential across different investment options.

Payout ratio adds crucial depth to dividend analysis by measuring what percentage of company earnings are distributed to shareholders. The formula—dividends paid divided by net income—reveals management’s approach to balancing shareholder returns with business reinvestment. Swiss wealth managers typically prefer companies maintaining payout ratios between 40-60%, indicating sustainable dividend policies that preserve capital for growth opportunities.

Dividend coverage ratio provides the safety perspective by calculating how many times a company’s earnings can support its dividend obligations. Companies with coverage ratios above 2.0 demonstrate strong dividend security, while ratios below 1.5 signal potential sustainability concerns that warrant careful investigation.

The Critical Timeline: Mastering Dividend Payment Dates

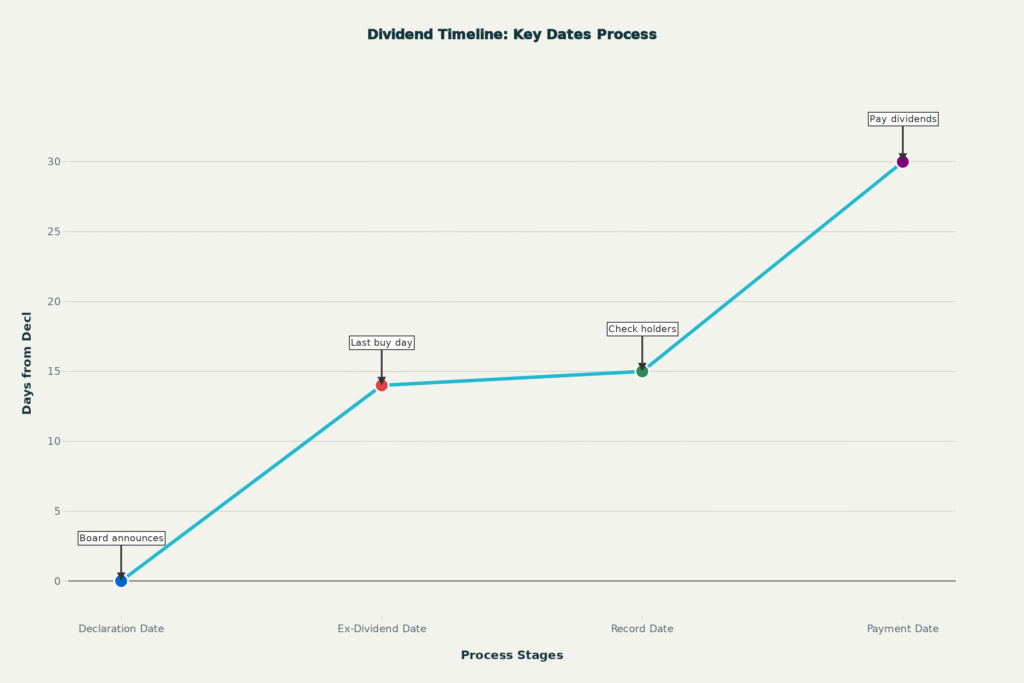

Understanding the dividend payment timeline separates sophisticated investors from those who miss opportunities or make costly timing mistakes. This process unfolds across four critical dates, each carrying specific implications for dividend eligibility and investment strategy.

The declaration date marks when a company’s board of directors announces the upcoming dividend, setting the entire timeline in motion. This announcement typically includes the dividend amount, payment date, and crucially, the ex-dividend date that determines investor eligibility.

The ex-dividend date represents the most critical deadline in the entire dividend process. Investors must own shares before this date to receive the declared dividend. Purchase shares on or after the ex-dividend date, and you forfeit that dividend payment entirely—a mistake that costs uninformed investors millions annually.

The record date follows one business day after the ex-dividend date, when companies compile their official shareholder lists to determine dividend recipients. The payment date concludes the process, typically occurring 2-4 weeks later, when dividends are actually distributed to eligible shareholders.

Advanced Terminology: Sophisticated Concepts for Serious Investors

Dividend aristocrats represent the elite tier of dividend-paying companies—S&P 500 stocks that have increased their dividends annually for at least 25 consecutive years. These companies demonstrate exceptional dividend reliability and growth, making them cornerstone holdings for income-focused portfolios. Currently, 69 companies maintain this prestigious designation, including household names like Coca-Cola, Johnson & Johnson, and Walmart.

Dividend kings elevate the standard even further, requiring 50+ years of consecutive dividend increases. These ultra-elite companies, fewer than 30 in total, represent the pinnacle of dividend sustainability and provide unmatched income security for long-term investors.

Dividend Reinvestment Plans (DRIPs) offer a powerful wealth-building mechanism that automatically reinvests dividend payments to purchase additional shares. This systematic approach harnesses the mathematical power of compounding, where reinvested dividends generate their own dividends in an accelerating cycle of wealth creation.

Cum-dividend and ex-dividend trading statuses indicate whether a stock trade includes dividend rights. Stocks trading cum-dividend entitle new buyers to the upcoming dividend, while ex-dividend stocks trade without this benefit, typically resulting in stock price adjustments equal to the dividend amount.

Specialized Dividend Categories and Structures

Cash dividends represent the most common and straightforward dividend type, distributing actual currency to shareholders based on their share ownership. These payments provide immediate income that investors can spend, save, or reinvest according to their financial objectives.

Stock dividends offer an alternative approach, distributing additional shares rather than cash. While stock dividends don’t provide immediate income, they increase ownership stakes and potentially amplify future dividend payments as share counts grow over time.

Special dividends emerge as one-time payments separate from regular dividend schedules. Companies typically declare special dividends following exceptional profits, asset sales, or other extraordinary circumstances that generate surplus cash beyond normal operations.

Preferred dividends carry different characteristics than common stock dividends, typically offering fixed payment amounts with priority over common shareholders during distribution. These structured payments provide more predictable income streams but usually lack the growth potential of common stock dividends.

Industry-Specific Terminology and Applications

Real Estate Investment Trust (REIT) dividends operate under special regulations requiring distribution of at least 90% of taxable income to shareholders. This regulatory framework creates naturally high-yielding investments, with many REITs offering yields in the 4-8% range supported by diversified property portfolios and long-term lease agreements.

Master Limited Partnership (MLP) distributions technically represent return of capital rather than traditional dividends, creating unique tax implications and cash flow characteristics. These energy infrastructure investments often provide attractive yields but require sophisticated tax planning due to their partnership structure.

Utility dividend policies reflect regulatory frameworks and capital-intensive business models that naturally support consistent dividend payments. Regulated utilities typically maintain conservative payout ratios while providing steady dividend growth aligned with rate base expansion and regulatory approvals.

Tax Implications and Terminology

Qualified dividends receive preferential tax treatment, typically taxed at capital gains rates rather than ordinary income rates. Most dividends from U.S. corporations and qualified foreign companies meet these criteria, providing significant tax advantages for long-term dividend investors.

Dividend tax credit systems vary by jurisdiction, with some countries offering credits or imputation systems that reduce or eliminate double taxation on corporate profits distributed as dividends. Understanding these systems becomes crucial for international dividend investing strategies.

Withholding taxes on foreign dividends add complexity to international income investing, requiring careful consideration of tax treaty benefits and foreign tax credit opportunities. Swiss investors, for example, benefit from extensive tax treaty networks that often reduce withholding rates on foreign dividend income.

Risk Assessment Terminology

Dividend sustainability analysis employs multiple metrics to evaluate long-term dividend security. This comprehensive approach examines free cash flow coverage, debt levels, earnings stability, and industry dynamics to assess whether current dividend payments can continue through various economic scenarios.

Dividend yield traps represent the dangerous scenario where high yields result from declining stock prices rather than generous dividend policies. Sophisticated investors learn to distinguish between genuinely attractive high-yield opportunities and yield traps that signal underlying business problems.

Coverage deterioration indicators warn of potential dividend cuts before they occur. Metrics like declining earnings coverage, negative free cash flow, and rising debt levels provide early warning signals that enable proactive portfolio adjustments.

Modern Dividend Investing Technology and Tools

Dividend screening software enables systematic identification of dividend opportunities based on multiple criteria including yield ranges, payout ratios, coverage metrics, and growth rates. These tools democratize access to institutional-quality dividend analysis previously available only to professional wealth managers.

Dividend calendars track upcoming ex-dividend dates, payment dates, and declaration schedules across entire portfolios or market segments. This systematic tracking prevents timing mistakes and enables strategic planning around dividend payment cycles.

DRIP automation platforms simplify dividend reinvestment across multiple holdings, often providing commission-free transactions and fractional share purchases that maximize compounding efficiency. Modern platforms calculate tax implications automatically while maintaining detailed records for reporting purposes.

Strategic Applications of Dividend Terminology

Dividend laddering strategies create predictable income streams by selecting stocks with staggered payment dates throughout each quarter. This approach smooths cash flow timing and reduces reinvestment risk by spreading dividend receipts across different market conditions.

Yield enhancement techniques employ covered call strategies, REIT allocations, and MLP investments to boost overall portfolio yields while managing associated risks. Understanding the terminology enables sophisticated implementation of these advanced income strategies.

Dividend growth investing focuses on companies demonstrating consistent dividend increases rather than simply high current yields. This approach prioritizes dividend aristocrats and companies with strong earnings growth that supports sustainable payout ratio expansion over time.

International Dividend Terminology Variations

Swiss dividend terminology includes unique concepts like scrip dividends, where companies offer shareholders choice between cash payments or additional shares. Understanding local terminology becomes essential for international diversification strategies.

European dividend policies often feature annual rather than quarterly payments, requiring different planning approaches and cash flow management strategies. Many European companies also offer dividend options that provide flexibility in payment timing or form.

Emerging market dividend practices vary significantly across jurisdictions, with some countries offering bonus shares, stock splits, or rights offerings in conjunction with dividend payments. These variations require careful terminology understanding to avoid confusion and optimize investment outcomes.

Conclusion: Mastering the Language of Dividend Success

Dividend terminology mastery transforms your investment capabilities from basic understanding to sophisticated wealth management. Like the precision timepieces crafted in Swiss workshops, successful dividend investing requires attention to every detail—from yield calculations and payout ratios to ex-dividend dates and DRIP strategies.

The terminology we’ve explored today forms the foundation for informed investment decisions, clear communication with financial advisors, and sophisticated portfolio construction that generates sustainable income over decades. Whether you’re evaluating dividend aristocrats, calculating coverage ratios, or planning around payment dates, this vocabulary enables precise analysis and strategic implementation.

As your Swiss wealth management guide, I encourage you to reference this terminology regularly as you develop your dividend investing expertise. Master these concepts, apply them systematically, and watch as your investment conversations become more sophisticated, your analysis more precise, and your dividend portfolio more successful.

The language of dividends opens doors to investment opportunities that reward patient, informed investors with growing income streams and long-term wealth accumulation. Your journey toward dividend mastery continues with each term understood, each calculation mastered, and each strategic decision informed by comprehensive knowledge of this essential financial vocabulary.

In the tradition of Swiss precision and excellence, let these terms guide your path toward dividend investing success, where knowledge compounds alongside your investments to create lasting financial prosperity.