Introduction

I still remember the day I visited my grandfather’s chalet in the Swiss Alps. He proudly showed me an intricate old clock, assembled piece by piece over generations. Each gear and spring had its purpose, and together they kept perfect time. Building a reliable passive-income stream through dividend investing feels much the same. You need dependable components—companies with decades-long track records of rewarding shareholders. In this post, I’ll guide you through Europe’s dividend champions, helping you craft a portfolio as precise and robust as that heirloom clock.

Why European Dividend Champions Matter

Many investors focus on U.S. dividend aristocrats, but European champions deserve equal attention. These companies have navigated multiple economic cycles, regulatory changes, and currency fluctuations while maintaining—or even growing—their payouts. Consequently, they provide:

- Stable Income: Consistent dividends help smooth out market volatility.

- Diverse Exposure: European markets offer sectors underrepresented in the U.S., such as luxury goods, healthcare, and real estate.

- Yield Opportunities: Dividend yields in Europe often exceed those in U.S. indexes, enhancing income potential.

As we explore these opportunities, I’ll share how to combine broad-based ETFs with individual stock selection to create a resilient, yield-focused portfolio.

Defining a Dividend Champion

A true dividend champion in Europe meets two rigorous criteria:

- Longevity of Increases: At least 25 consecutive years of dividend growth or stable payouts.

- Financial Strength: Healthy free cash flow, sustainable payout ratios, and strong balance sheets.

These benchmarks ensure the company can weather downturns, regulatory changes, and competitive challenges—just like that mountain clock survives generations of alpine winters.

The Elite Five: Europe’s Dividend Aristocrats

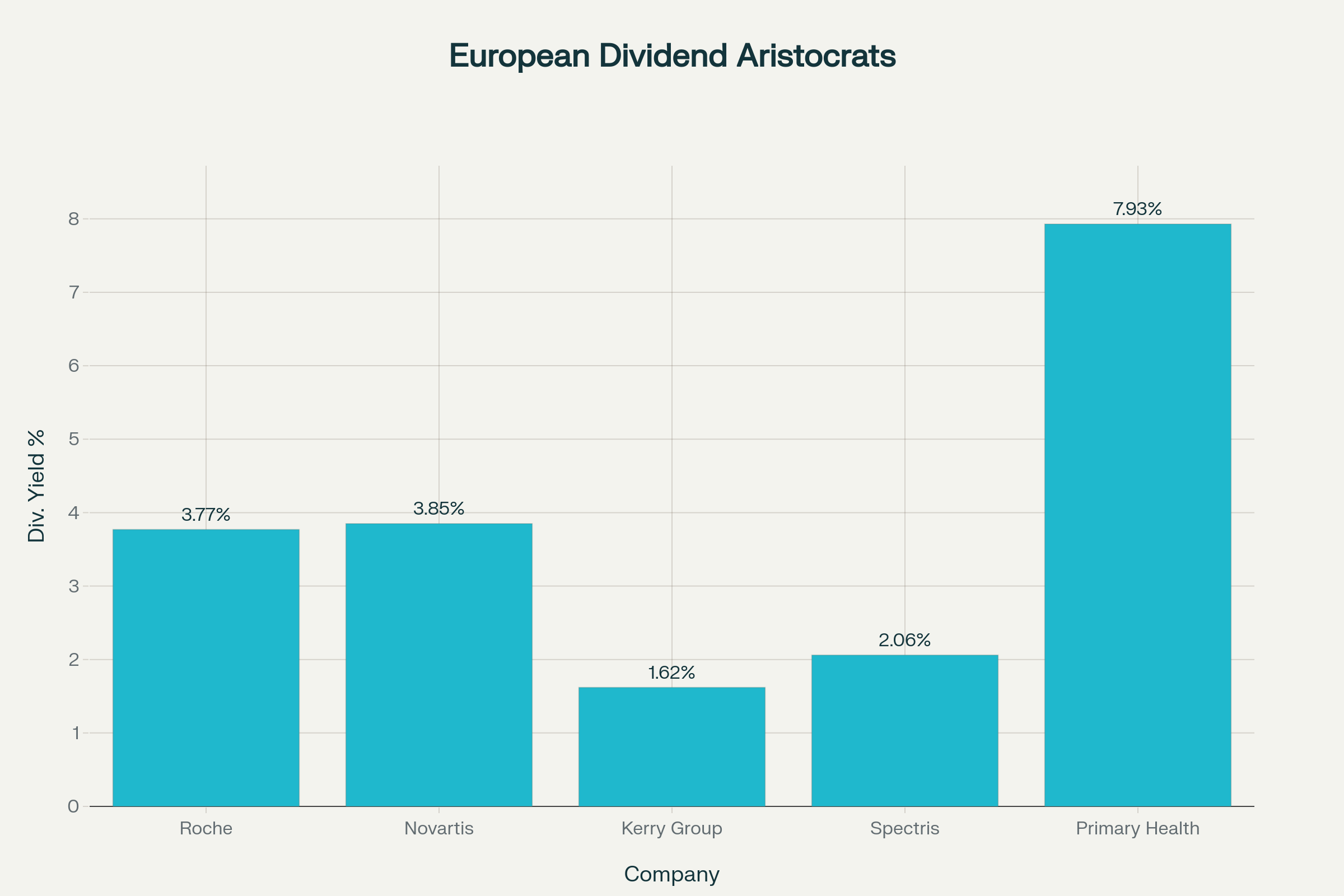

Based on Morningstar’s latest data, only five European companies boast 25+ years of annual dividend increases:

- Roche Holding AG (Healthcare): Forward yield 3.77%

- Novartis AG (Healthcare): Forward yield 3.85%

- Kerry Group plc (Food & Beverage): Forward yield 1.62%

- Spectris plc (Industrial Technology): Forward yield 2.06%

- Primary Health Properties PLC (Real Estate): Forward yield 7.93%

Forward dividend yields of top European dividend aristocrats

These firms span defensive sectors like healthcare and real estate, as well as growth-oriented industries such as specialty chemicals and industrial technology. Let’s visualize their yields to appreciate the spectrum of income they provide.

Visualizing Dividend Yields

Below is a bar chart comparing the forward dividend yields of these elite European champions. You’ll notice that asset-heavy sectors like real estate offer higher yields, while pharmaceutical giants trade yield for stability and growth potential.

Sector Breakdown and Business Models

Understanding each champion’s business model helps clarify why they sustain payouts:

Healthcare Giants: Roche and Novartis

Both headquartered in Switzerland, Roche and Novartis deliver essential medicines and diagnostics worldwide. Their durable patent portfolios and strong research pipelines generate predictable cash flows. Even during economic slowdowns, people prioritize healthcare, making these companies defensive anchors in any dividend portfolio.

- Roche’s diagnostics division recently helped manage global health challenges, reinforcing its free cash flow.

- Novartis reported a steady stream of blockbuster drug launches, supporting consistent dividend increases.

Food & Beverage: Kerry Group

Ireland’s Kerry Group specializes in food ingredients and flavors. Its B2B business model sells essential inputs to large consumer goods companies. Although its yield is lower than other champions, Kerry’s diversified geographic footprint and innovation in health-focused ingredients undergird its dividend pedigree.

Industrial Technology: Spectris

Spectris, based in the U.K., provides instrumentation and controls to industries like aerospace and energy. Its niche products command high margins, and its global service network fosters recurring revenue. While industrial demand can ebb and flow, Spectris’s focus on mission-critical equipment helps sustain its payout.

Real Estate Income: Primary Health Properties

Primary Health Properties (PHP) invests in medical facilities across the U.K. Its long-term leases to healthcare providers, often backed by government funding, create reliable rental income. This model explains PHP’s standout 7.93% yield, though investors must monitor interest-rate trends and real estate valuations.

Core ETF Strategies for Broad Exposure

If individual stock selection feels daunting, you can still capture Europe’s dividend strength through ETFs:

- iShares EURO STOXX Select Dividend 30 ETF (Dist): Tracks 30 high-yielding Eurozone stocks, offering a forward yield of approximately 4.57%. Its sector mix leans toward financials, industrials, and consumer discretionary.

- SPDR S&P Euro High Yield Dividend Aristocrats UCITS ETF: Screens for companies with 10+ years of payout growth and yields above the broader index average.

Using these ETFs provides diversified, cost-efficient access to leading dividend payers. You’ll gain:

- Instant Diversification: No need to pick individual companies.

- Rebalancing Efficiency: Fund managers adjust holdings based on transparent rules.

- Liquidity: ETFs trade throughout the day, offering flexibility.

Constructing Your Alpine-Grade Portfolio

Let’s piece together a portfolio as meticulously as a Swiss watchmaker:

1. Foundation with ETFs

Allocate 50–70% of your Europe dividend allocation to dividend-aristocrat ETFs. This core position ensures diversified exposure across sectors and countries.

2. Select Champions

Dedicate 20–30% to individual aristocrats like Roche and Novartis. These global leaders balance growth and stability. Their decades-long payout histories make them reliable income sources.

3. Yield Enhancers

Reserve 10–20% for higher-yield names such as Primary Health Properties or specialty real-estate REITs. These add income punch but may carry more interest-rate or sector-specific risk.

4. Tax & Currency Management

- Tax-Efficient Vehicles: Use accumulation-class funds or domiciled ETFs in low-withholding-tax jurisdictions (e.g., Ireland, Luxembourg) to minimize dividend leakage.

- Hedged Share Classes: Consider euro-hedged ETFs if you prefer predictable returns in your home currency. Alternatively, embrace currency diversification to hedge against dollar weakness.

Risk Considerations

Even the most reliable engines need maintenance. Key risks include:

- Withholding Taxes: Cross-border dividends may incur 15–35% taxes before any treaty relief.

- Interest-Rate Sensitivity: Higher yields often correlate with real-estate or utility stocks, which can underperform when rates rise.

- Economic Cycles: Industrial and consumer-discretionary dividend champions may cut payouts in deep recessions.

By blending sectors and instruments, you can mitigate these risks—much like Swiss farmers rotate crops to maintain healthy soil.

Tracking and Rebalancing

To keep your portfolio aligned:

- Quarterly Reviews: Check fund and stock performance, yield changes, and sector weights.

- Rebalancing Thresholds: If any holding drifts more than 5% from its target weight, trim or add accordingly.

- Dividend Reinvestment: Reinvest payouts to harness compound growth over time.

Key Takeaways

- True European dividend champions demonstrate 25+ years of uninterrupted payouts.

- Yields range from 1.6% (Kerry) to 7.9% (PHP), reflecting sector dynamics.

- ETFs like EURO STOXX Select Dividend 30 offer 4–5% yields with broad diversification.

- A Swiss-style portfolio blends ETFs, global champions, and yield enhancers for balanced income.

- Tax planning and currency strategies enhance net returns.

Conclusion

As I closed the back of that old chalet clock, I realized that both timepieces and dividend portfolios require precision, quality components, and regular upkeep. By combining broad ETF exposure with select European dividend champions—and by minding tax and currency nuances—you can craft a passive-income engine that ticks with Swiss reliability. Next, we’ll explore “Dividend Reinvestment Strategies: Compounding Your European Income”, unlocking the power of growing your alpine-grade portfolio even further.