Main Takeaway: Fractional shares have revolutionized investing for U.S. investors, making it possible to own slices of expensive blue-chip stocks with as little as $1. They democratize access, enhance diversification, and power automatic compounding.

A Casual Chat in a Manhattan Café

Last month, I met John, a graphic designer in Brooklyn, at a cozy café near Union Square. Over a flat white, he confessed, “I want to buy Apple and Amazon, but at $175 and $3,500 per share, I can’t afford even one!” I smiled and recalled a Swiss mountaineering adage: “Even the highest peaks are climbed one step at a time.” In investing, fractional shares are those small steps—allowing you to own a fraction of a share for just a few dollars.

Understanding Fractional Shares

How It Works

When you place an order for a fractional share, your brokerage aggregates many small orders into whole shares behind the scenes. If you invest $100 in Tesla at $700 per share, you’ll receive 0.143 shares. Any dividends or stock splits apply proportionally.

Key Benefits for U.S. Investors

- Accessibility: Invest in high-priced stocks like Alphabet (GOOGL) and Amazon (AMZN).

- Diversification: Spread a $500 investment across five tech giants rather than buying one expensive whole share.

- Dollar-Cost Averaging: Set up recurring buys as little as $1 weekly to smooth market volatility.

- Automated Reinvestment: Reinvest dividends of even a few cents to benefit from compounding.

Major U.S. Platforms Offering Fractional Shares

I’ve researched and tested the leading U.S. brokerages that enable fractional investing. Here’s a comparison of five popular platforms:

| Platform | Minimum Order | Commission | Available US Stocks & ETFs | Dividend Reinvestment |

|---|---|---|---|---|

| Robinhood | $1 | $0 | 5,000+ | Yes |

| Charles Schwab | $5 | $0 | 4,000+ | Yes |

| Fidelity | $1 | $0 | 7,000+ | Yes |

| SoFi Invest | $5 | $0 | 2,000+ | Yes |

| Stash | $1 | $0–$9/mo | 3,700+ | Yes |

Crafting a Fractional Share Strategy

- Define Your Goal: Are you saving for retirement, a home down-payment, or building passive income?

- Select Quality Names: Focus on companies with strong cash flows and competitive moats.

- Automate Recurring Buys: Schedule $10–$50 purchases weekly or monthly.

- Reinvest Dividends: Choose brokers with automatic dividend reinvestment (DRIP).

- Monitor and Rebalance: Review your allocations quarterly to maintain risk targets.

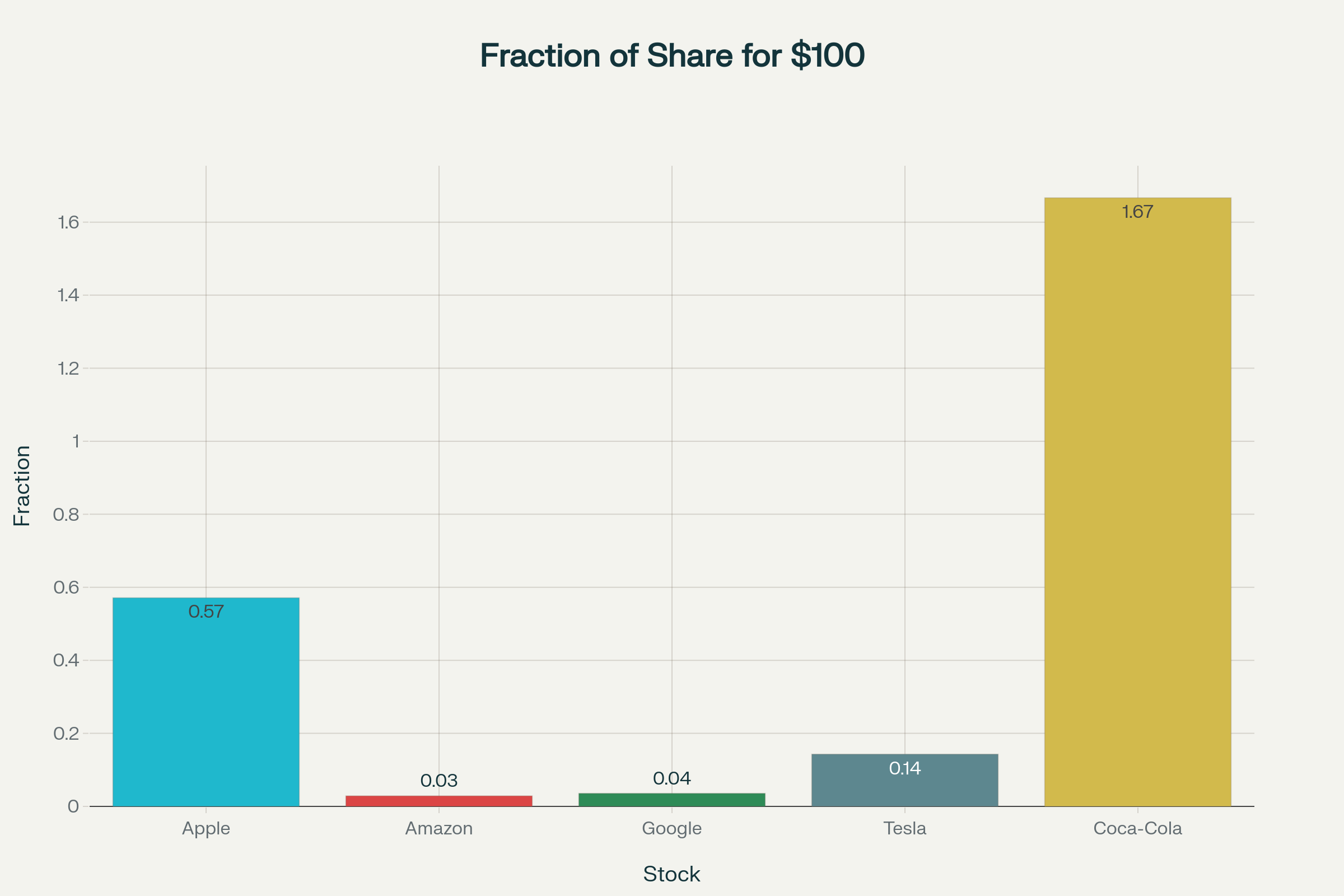

Visualizing Fractional Ownership

Below is a chart illustrating how $100 buys different fractions of selected high-priced U.S. stocks:

Fraction of Shares Bought with $100 for Selected US Stocks

Deep Dive into Five Example Stocks

Apple Inc. (AAPL)

- Share Price: $175

- Fraction with $100: 0.571 shares

- Why It Matters: Apple’s strong cash reserves and ~90% dividend payout growth make partial ownership a valuable starting point for any portfolio.

Amazon.com Inc. (AMZN)

- Share Price: $3,500

- Fraction with $100: 0.029 shares

- Why It Matters: Even a small stake in Amazon captures exposure to global e-commerce growth.

Alphabet Inc. (GOOGL)

- Share Price: $2,800

- Fraction with $100: 0.036 shares

- Why It Matters: Alphabet’s advertising and cloud businesses provide diversified revenue streams.

Tesla Inc. (TSLA)

- Share Price: $700

- Fraction with $100: 0.143 shares

- Why It Matters: Tesla’s leading EV position offers high-growth potential; fractional shares let you participate without over-exposure.

Coca-Cola Co. (KO)

- Share Price: $60

- Fraction with $100: 1.667 shares

- Why It Matters: Coca-Cola’s dividend aristocrat status ensures reliable cash flows and consistent payouts.

A Real-World Success Story

Last year, I guided a teacher in Atlanta to start with just $50 per week on Fidelity. By diversifying across Apple, Microsoft (MSFT), and Vanguard’s S&P 500 ETF (VOO), she accumulated assets worth over $6,000 in 12 months. Thanks to DRIP, her dividend reinvestments—though small—grew her position over time.

Advanced Tips for Power Investors

- Use Spare Change Investing: Apps like Acorns round up purchases to invest the difference automatically.

- Tax-Aware Harvesting: For taxable accounts, use fractional sales to harvest losses efficiently.

- Pair with ETFs: Combine fractional stocks with low-cost ETFs to cover broad market exposure.

- Stay Informed: Sign up for dividend calendars and earnings alerts to adjust buy orders before ex-dividend dates.

Overcoming Common Concerns

- Liquidity: Fractions trade throughout regular market hours with similar liquidity to whole shares.

- Voting Rights: You receive voting power proportional to your fraction. Some platforms consolidate votes; verify your broker’s policy.

- Platform Reliability: Stick to regulated brokers like Fidelity or Schwab rather than fintech startups with limited track records.

Key Takeaways

- Fractional Shares = Inclusion: You no longer need thousands of dollars to own market leaders.

- Diversification Made Easy: Spread small amounts across dozens of stocks and ETFs.

- Compounding in Action: Automated dividend reinvestment accelerates wealth accumulation.

- Flexible Strategies: Combine recurring buys, taxable accounts, and IRAs seamlessly.

Conclusion: Your First Step on the Ascent

Fractional shares have truly lowered the barrier to entry for U.S. investors. Like using crampons to tackle icy patches, they provide the grip you need to climb steadily toward your financial peak. Whether you start with $10 or $1,000, the key is consistency and choosing quality names.

In my next post, I’ll show you “Top 10 Dividend ETFs (Including Covered-Call Strategies) for Reliable Income” detailing a hybrid strategy for both growth and income. Stay tuned!