Main takeaway: For investors seeking steady passive income, a mix of traditional high-dividend ETFs and income-enhancing covered-call ETFs can balance yield with capital appreciation. Traditional dividend ETFs offer broad market exposure, while covered-call ETFs deliver higher current income at the cost of some upside participation.

1. Engaging with Income: A Swiss Watch Analogy

Investing for dividends is like owning a meticulously crafted Swiss watch. The gears (your underlying stocks) tick steadily, while the ticking sound (dividend payments) reminds you of consistent, reliable progress. Just as a watchmaker designs for precision and durability, dividend ETFs are engineered to provide stable income over time.

2. Traditional Dividend ETFs: The “Engine” of Income

Vanguard High Dividend Yield ETF (VYM)

- Yield: ~3.2%

- Expense Ratio: 0.06%

Tracks the FTSE High Dividend Yield Index, offering broad exposure to U.S. companies with above-average yields.

Schwab U.S. Dividend Equity ETF (SCHD)

- Yield: ~3.9%

- Expense Ratio: 0.06%

Focuses on high-quality U.S. stocks with a history of dividend growth and strong fundamentals.

SPDR S&P Dividend ETF (SDY)

- Yield: ~2.7%

- Expense Ratio: 0.35%

Invests in companies in the S&P Composite 1500 with at least 20 consecutive years of dividend increases.

iShares Core High Dividend ETF (HDV)

- Yield: ~3.7%

- Expense Ratio: 0.08%

Selects U.S. stocks screened for high dividend yields and financial health.

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

- Yield: 3.33%

- Expense Ratio: 0.30%

Combines high dividend yield with low volatility by investing in the least volatile, high-yielding S&P 500 stocks.

SPDR S&P U.S. Dividend Aristocrats UCITS ETF (SPYD)

- Yield: 2.99%

- Expense Ratio: 0.35%

Holds U.S. companies with 20+ years of dividend increases, blending quality with income.

Vanguard Dividend Appreciation ETF (VIG)

- Yield: ~1.7%

- Expense Ratio: 0.06%

Targets companies with strong histories of increasing dividends, focusing more on growth.

iShares Select Dividend ETF (DVY)

- Yield: ~3.5%

- Expense Ratio: 0.39%

Screens for U.S. stocks with high dividend yields and stable payouts.

Global X SuperDividend ETF (SDIV)

- Yield: 10.91%

- Expense Ratio: 0.58%

A global basket of 100 equally-weighted highest dividend–paying companies.

WisdomTree U.S. Dividend Growth Fund (DGRW)

- Yield: ~1.6%

- Expense Ratio: 0.28%

Focuses on U.S. companies expected to grow dividends, combining yield with long-term growth.

3. Covered-Call ETFs: “Income-Boosters” with a Trade-Off

Covered-call ETFs sell call options on their holdings to generate option premiums, enhancing yield but capping upside participation. They are akin to a shepherd who rotates grazing fields: yielding consistent return (income) while sacrificing some of the pasture (stock gains).

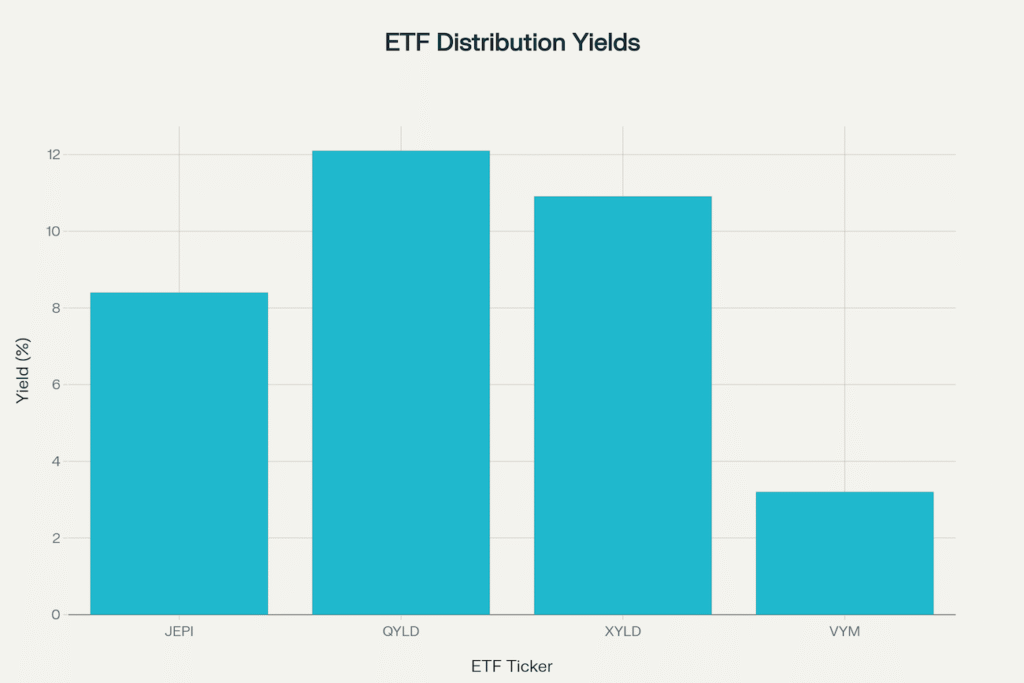

- JPMorgan Equity Premium Income ETF (JEPI)

Yield: 8.4% – Expense Ratio: 0.35%

Actively managed U.S. equity portfolio with equity-linked notes overlay, aiming for defensive income. - Global X Nasdaq 100 Covered Call ETF (QYLD)

Yield: 12.1% – Expense Ratio: 0.60%

Tracks the Nasdaq-100 BuyWrite Index, selling calls to deliver monthly income. - Global X S&P 500 Covered Call ETF (XYLD)

Yield: 10.91% – Expense Ratio: 0.60%

Employs a buy-write on the S&P 500, offering reliable monthly distributions.

4. Yield Comparison Chart

Below is a bar chart illustrating how covered-call ETFs’ yields stack up against a traditional high-dividend ETF:

5. How to Choose Between Traditional and Covered-Call ETFs

- Income needs vs. growth potential:

- Traditional ETFs offer moderate yields and full participation in market rallies.

- Covered-call ETFs deliver higher yields but cap upside beyond strike prices.

- Volatility tolerance:

- Covered-call strategies cushion small downturns via premiums but lag sharply in strong bull markets.

- Expense considerations:

- Covered-call ETFs often have higher expense ratios (0.35–0.60%) versus 0.06–0.39% for traditional ETFs.

- Tax implications:

- Option premium income may be taxed differently than qualified dividends, depending on jurisdiction.

6. Key Takeaways

- Traditional dividend ETFs (e.g., VYM, SCHD) provide broad market exposure with stable, moderate yields.

- Covered-call ETFs (JEPI, QYLD, XYLD) can boost income to 8–12% but limit upside.

- Expense ratios and tax treatment are crucial when selecting the right vehicle.

- A balanced portfolio may combine both ETF types to optimize yield and growth.

7. Conclusion and Next Steps

Dividend investing is like mounting a Swiss alpine expedition: choosing reliable partners (ETFs) and balancing risk (upside cap) with steady progress (income). In the next post, we will explore tax-efficient structures and global diversification for dividend portfolios, guiding you further up the peak of passive income success.