Imagine walking into the elegant marble halls of a Swiss private bank, where whispered conversations about dividend strategies echo through corridors lined with centuries of financial wisdom. As Asel, a Swiss wealth management expert with over fifteen years of experience guiding high-net-worth clients through the complexities of dividend investing, I’ve witnessed countless investors transform their financial futures through the power of understanding what dividends truly represent.

The story begins not with numbers or formulas, but with a fundamental question that every investor must answer: How can your money work for you while you sleep? The answer lies in mastering the art of dividend investing, starting with understanding the cornerstone concept—what is a dividend?

The Essence of Dividends: More Than Just Cash Payments

A dividend represents far more than a simple cash payment. Think of it as a company’s way of sharing its success story with you, the shareholder. When a company generates profits beyond what it needs for operations and growth, the board of directors faces a critical decision: reinvest everything back into the business or reward shareholders who believed in the company’s vision.

Dividends are essentially the company’s method of saying, “Thank you for investing in our future—here’s your share of our success”. These payments typically flow from a company’s earnings and represent a direct transfer of value from the corporate treasury to your investment account.

The beauty of dividend payments lies in their dual nature. Unlike volatile stock prices that fluctuate with market sentiment, dividends provide a tangible return that you can hold, spend, or reinvest regardless of whether the stock market is climbing toward new heights or tumbling through uncertain times.

Understanding Dividend Types: The Swiss Precision Approach

Just as Swiss watchmakers craft different timepieces for various occasions, companies distribute different types of dividends to meet diverse investor needs and corporate objectives.

Cash dividends represent the most straightforward and widely recognized form. When a company declares a cash dividend, shareholders receive a specified amount of money per share they own. For instance, if you own 200 shares of a company paying a $1.50 quarterly dividend, you’ll receive $300 every quarter—a predictable income stream that many investors, particularly retirees, find invaluable.

Stock dividends offer an alternative approach, distributing additional shares rather than cash. If you hold 100 shares and the company declares a 10% stock dividend, you’ll receive 10 additional shares. While this doesn’t provide immediate income, it increases your ownership stake in the company, potentially amplifying future dividend payments and capital appreciation.

Special dividends emerge as unexpected gifts, typically declared when companies experience windfall profits from asset sales or extraordinary business performance. These one-time payments supplement regular dividend schedules, providing shareholders with additional returns during exceptional corporate achievements.

The Mathematics of Dividend Success: Yield Calculations Demystified

Dividend yield serves as the compass guiding income-focused investors through the vast landscape of dividend-paying stocks. The calculation appears deceptively simple:

Dividend Yield = Annual Dividends per Share ÷ Current Stock Price

However, understanding the deeper implications requires Swiss-level precision. Consider two companies: Company A trading at $100 per share with annual dividends of $4.00, and Company B trading at $50 per share with annual dividends of $2.50. Company A offers a 4% yield, while Company B provides a 5% yield. The higher yield doesn’t automatically make Company B superior—context matters enormously.

A high dividend yield might indicate an undervalued stock with exceptional income potential, or it could signal underlying business troubles that have driven the stock price down. Successful dividend investors distinguish between dividend opportunities and yield traps through careful analysis of company fundamentals, cash flow stability, and dividend sustainability.

The Strategic Timeline: Mastering Dividend Payment Mechanics

Understanding the dividend payment process transforms novice investors into sophisticated income strategists. The timeline unfolds across four critical dates that every serious dividend investor must master:

The declaration date marks when the company’s board announces the upcoming dividend, setting the stage for the entire process. This announcement often triggers immediate market reactions as investors digest the news and adjust their expectations.

The ex-dividend date represents the most crucial deadline for dividend qualification. Investors must own the stock before this date to receive the declared dividend. Purchase the stock on or after the ex-dividend date, and you’ve missed the opportunity for that particular payment cycle.

The record date follows one business day after the ex-dividend date, when the company compiles its official shareholder list to determine dividend recipients. The payment date concludes the process, typically occurring within 2-4 weeks, when dividends are actually distributed to eligible shareholders.

Global Dividend Leaders: Learning from the Aristocrats

Dividend aristocrats represent the gold standard of dividend investing—S&P 500 companies that have increased their dividends annually for at least 25 consecutive years. These financial champions demonstrate remarkable consistency, weathering economic storms while continuing to reward shareholders with growing income streams.

Currently, 64 companies hold this prestigious designation, including household names like Coca-Cola (63 years of consecutive increases), Johnson & Johnson (63 years), and Procter & Gamble (69 years). These companies prove that sustainable dividend growth stems from strong business models, disciplined capital allocation, and management teams committed to shareholder value creation.

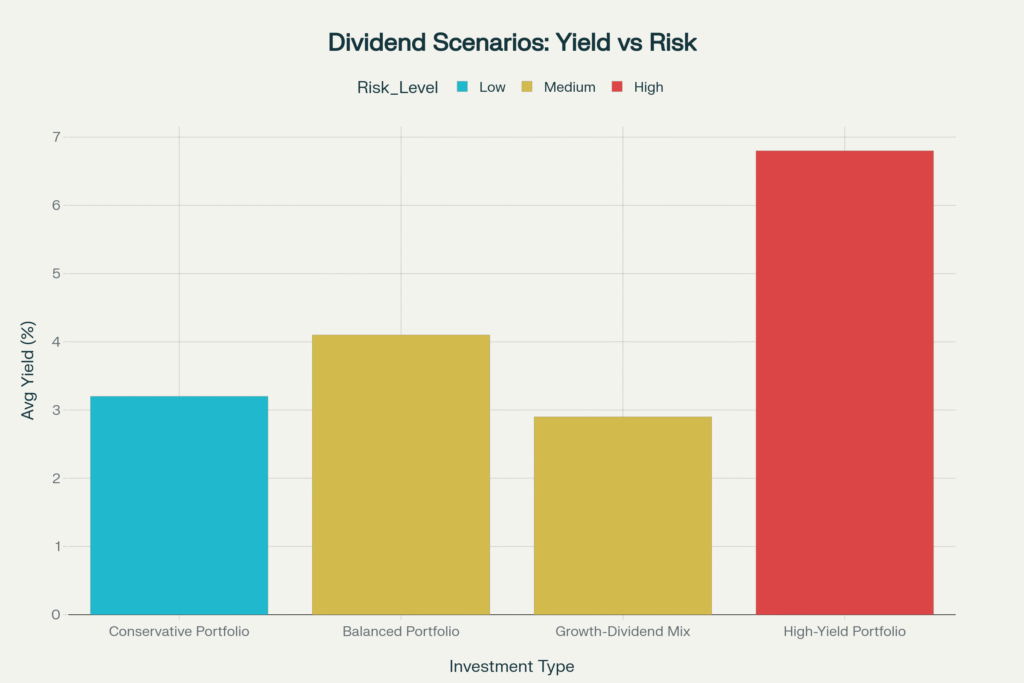

The dividend aristocrats offer yields ranging from conservative levels around 1-2% for growth-oriented companies to attractive 4-6% yields for more income-focused enterprises. This diversity allows investors to construct dividend portfolios aligned with their specific income requirements and risk tolerance.

2025 Market Dynamics: The Renaissance of Dividend Investing

Dividend investing in 2025 has experienced a remarkable renaissance, with dividend strategies outperforming broader market indices for the first time in nearly a decade. The Morningstar Dividend Leaders Index has climbed 6.5% year-to-date, more than doubling the 3.0% gain of the broader US market.

This resurgence reflects several powerful trends reshaping the investment landscape. Rising interest rates have increased the relative attractiveness of dividend yields compared to risk-free government securities. Major technology companies, traditionally focused on growth over income, have begun implementing meaningful dividend programs, expanding the universe of dividend-paying stocks across previously growth-only sectors.

Market concentration in mega-cap technology stocks has created unusual valuation opportunities in dividend-paying companies across defensive sectors like utilities, healthcare, and consumer staples. This shift provides astute dividend investors with attractive entry points into quality companies trading at reasonable valuations.

Building Your Dividend Foundation: A Swiss Wealth Management Perspective

Successful dividend investing requires more than simply selecting high-yielding stocks. It demands a comprehensive understanding of how dividends fit within your broader wealth-building strategy, much like how Swiss private banks construct portfolios with precision and purpose.

Dividend income provides several distinct advantages that complement capital appreciation strategies. First, dividends offer inflation protection through companies’ ability to raise payments over time as their earnings grow. Second, dividend payments provide portfolio stability during market downturns, when dividend-paying stocks often demonstrate greater resilience than their growth-oriented counterparts.

The compounding effect of dividend reinvestment represents perhaps the most powerful wealth-building mechanism available to patient investors. By automatically reinvesting dividends to purchase additional shares, investors harness the mathematical miracle of compound growth, where reinvested dividends generate their own dividends in an accelerating cycle of wealth creation.

Risk Management: The Swiss Approach to Dividend Investing

Even the most carefully selected dividend stocks carry inherent risks that sophisticated investors must acknowledge and manage. Dividend cuts represent the most immediate threat, particularly during economic downturns when companies prioritize cash conservation over shareholder distributions.

Interest rate sensitivity affects dividend stocks differently than growth stocks, with rising rates potentially making dividend yields less attractive compared to risk-free government bonds. Sector concentration poses another challenge, as dividend-paying companies often cluster in specific industries like utilities, telecommunications, and consumer staples, potentially limiting diversification benefits.

Management discretion adds another layer of uncertainty, as dividend policies remain subject to board decisions that may not always align perfectly with shareholder interests. Companies may reduce or eliminate dividends to fund growth initiatives, acquisitions, or to strengthen balance sheets during challenging periods.

The Future of Dividend Investing: Trends and Opportunities

Looking ahead, dividend investing continues evolving with changing market dynamics and investor preferences. The integration of environmental, social, and governance (ESG) considerations into dividend strategies reflects growing investor awareness of sustainable business practices.

Technological advancement has democratized access to sophisticated dividend analysis tools, enabling individual investors to conduct institutional-quality research on dividend sustainability, growth prospects, and valuation metrics. This technological transformation levels the playing field between individual and institutional investors.

Global diversification presents expanding opportunities as international markets offer unique dividend-paying companies with different risk-return profiles than traditional domestic options. Currency considerations add complexity but also potential benefits for investors seeking to diversify beyond home-country exposure.

Conclusion: Your Journey into Dividend Mastery

Understanding what is a dividend represents just the first step in your journey toward dividend investing mastery. Like the precision timepieces crafted in Swiss workshops, successful dividend strategies require patience, attention to detail, and a long-term perspective that values consistency over speculation.

Dividends offer a tangible connection between your investment capital and corporate success, providing income that can enhance your financial security while potentially growing over time. Whether you’re seeking supplemental retirement income, portfolio stability during volatile markets, or the mathematical power of compound growth through reinvestment, dividends provide a versatile tool for achieving diverse financial objectives.

As you embark on your dividend investing journey, remember that knowledge forms the foundation of investment success. Understanding dividend mechanics, recognizing quality dividend-paying companies, and managing associated risks will serve as your compass through the evolving landscape of income investing.

The story of dividend investing continues unfolding with each quarterly payment, each dividend increase, and each reinvested dollar that compounds into future wealth. Your chapter in this story begins with mastering the fundamentals—starting with the simple yet profound question we began with: What is a dividend?

Now you know the answer, and more importantly, you understand how to use this knowledge to build lasting financial prosperity through the time-tested strategy of dividend investing.